Narrative Collapses, Trust Evaporates: Trove Kicks Off This Year’s Crypto Rights Defense Campaign

As a Perp DEX focused on collectibles and RWAs, Trove claimed it could transform illiquid “cultural assets,” such as Pokémon cards, CSGO skins, and luxury items like watches, into tradable financial assets, providing a hedging venue for collectors.

However, in just ten days, the Trove team staged a farce through a series of astonishing operations, incidentally emptying the pockets of onlookers.

The Bait

In late October last year, Trove founder @unwisecap discussed the concept of “everything can be a Perp” in several posts and announced that Trove would be built on HIP-3, whetting the community’s appetite.

Over the following month, Trove successively announced partnerships with Kalshi and CARDS (Collector_Crypt), receiving official Twitter replies “endorsing” from these well-known projects. (P.S. As of the editor’s deadline, Kalshi had already completed the “cut,” deleting its reply under Trove’s official tweet.)

In mid-December, Trove announced the acquisition of over 500,000 HYPE tokens at a cost exceeding $20 million to meet the integration requirements of HIP-3. Shortly after, the testnet points program launched, and the platform’s trading volume broke through $1 million within two weeks. Everything was progressing as expected. Until…

A Textbook Case of Insider Trading

On January 6th, Trove suddenly announced an ICO with a $20 million FDV. The public sale adopted an “oversubscription” model, offering priority allocation rights to points holders. Accompanied by concentrated promotion from numerous KOLs wearing Trove badges, Trove successfully raised $11.5 million, oversubscribed by 4.6 times.

At this point, less than two hours remained until the ICO deadline. The probability for the “Trove ICO total raise exceeding $20 million” prediction market on Polymarket had already approached zero.

The real show began next. The team suddenly broke the rules, announcing a 5-day extension of the ICO period to ensure fair allocation. The “YES” option on Polymarket instantly skyrocketed from rock bottom to nearly 60%. Insider funds were clearly one step ahead. On-chain data showed specific wallets placing precise bets before the announcement and quickly exiting after the price surge.

Perhaps deeming the prediction market’s liquidity insufficient to satisfy their appetite, amidst a wave of community skepticism, the Trove team seized the opportunity to stage a “cry wolf” scenario: announcing the withdrawal of the extension decision and ending the ICO as originally planned.

Following this announcement, the corresponding market directly zeroed out and settled. Polymarket data indicated that related wallets placed precise bets before the news was publicized and continued to profit from the subsequent reversal.

The Great Retreat

On January 17th, Trove suddenly announced abandoning Hyperliquid and instead issuing its token on Solana. For a project that had consistently raised funds under the banner of the Hyperliquid ecosystem, this was akin to pulling the rug out from under itself.

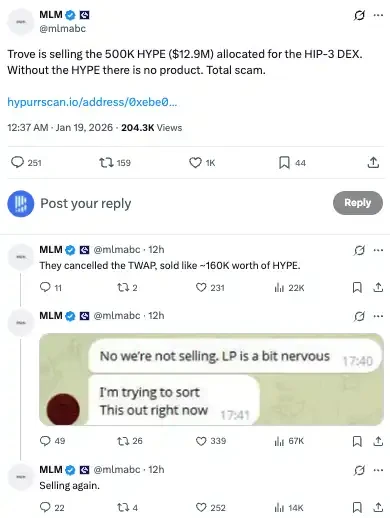

Simultaneously, on-chain detective MLM captured that the Trove team attempted to sell half of their HYPE tokens within 40 minutes using a timed selling function.

Choosing to sell millions of dollars worth of tokens in 40 minutes during the weekend with the worst liquidity, the Trove team was truly desperate.

Faced with质疑, the explanation provided by the Trove team appeared feeble: “Investors felt nervous and decided to exit.” However, on-chain transaction records showed these sell-offs occurred simultaneously while the team publicly denied “we are selling tokens.”

This inconsistency between words and actions completely shattered the community’s trust底线. As trust collapsed, more shady dealings were uncovered.

Renowned on-chain detective ZachXBT disclosed that the Trove team paid a marketing fee as high as $45,000 to @TJRTrades, directly depositing it into the KOL’s gambling website top-up address.

KOL @hrithikk stated that the Trove team not only provided generous marketing fees to KOLs but also privately offered ICO allocations at valuations as low as $8.5 million, a discount of up to 60%, accompanied by massive airdrop rewards. Currently, Trove is still selling allocations at low prices and has asked him over 5 times if he would invest in Trove.

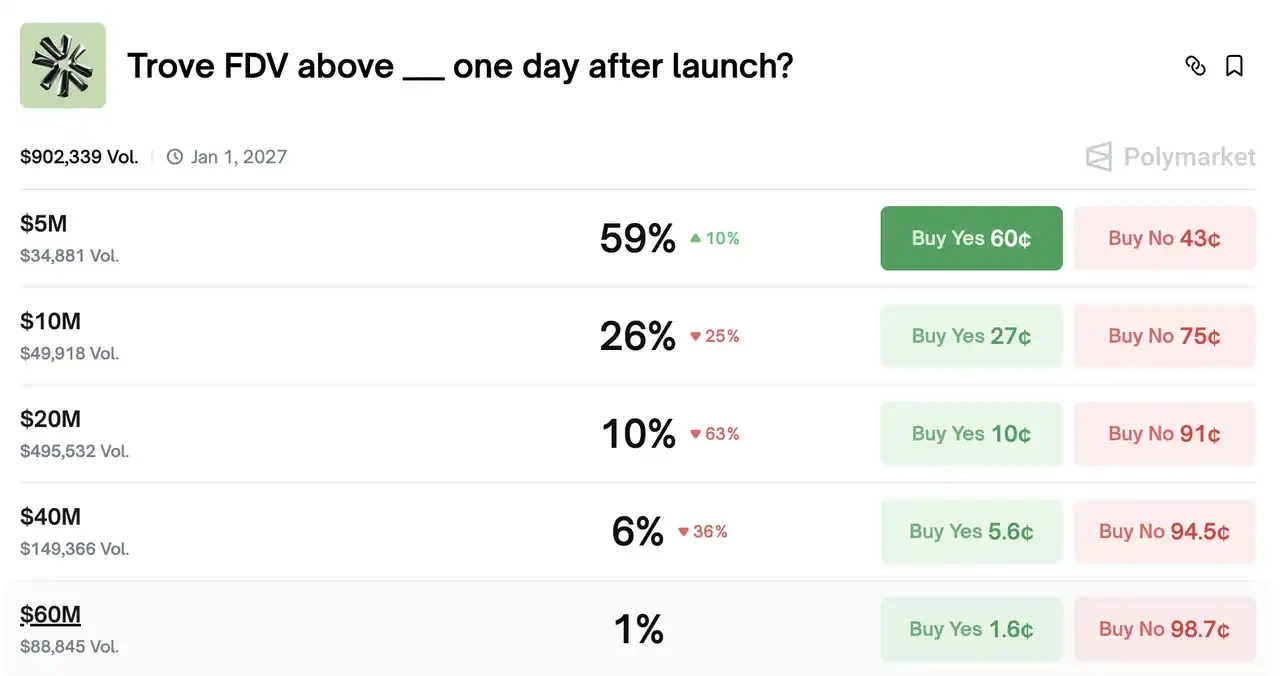

Trove’s TGE is scheduled for 1:00 AM Beijing Time on January 20th. Polymarket prediction market data shows, based on the presale valuation, there is a 90% probability the TROVE token will launch below its offering price.

The good news is that this farce might not end with a simple “Soft Rug.” Trove previously claimed on its official website to comply with the EU’s MiCA regulations. Now, facing allegations of false advertising and potential fraud, angry investors have every reason to initiate civil lawsuits based on MiCA provisions.

The bad news is that chat screenshots disclosed by KOLs suggest team members might be from Iran.

The Hyperliquid ecosystem is known for its strong community cohesion, but an atmosphere of excessive trust also provides fertile ground for scammers to thrive.

Artikel ini bersumber dari internet: Narrative Collapses, Trust Evaporates: Trove Kicks Off This Year’s Crypto Rights Defense Campaign

On one side, inflation is receding, AI is accelerating its penetration, and capital markets are stirring; on the other side, geopolitical friction, rising institutional uncertainty, and widespread skepticism about whether “the next round of growth truly exists” prevail. Against this backdrop, the globally influential tech business podcast *All-In Podcast* released its annual ultimate predictions: Hosted by renowned Silicon Valley angel investor (early investor in Uber and Robinhood) Jason Calacanis, the episode featured three heavyweight guests: “SPAC King” Chamath, “Science Sultan” David Friedberg, and David Sacks, known to the outside world as the White House’s first “AI and Crypto Czar.” These top minds, controlling hundreds of billions of dollars and deeply versed in the logic of power and capital, engaged in a fiery debate around politics, technology, investment, and the geopolitical…