Coinbase’s L2 suddenly changes its stance on coin issuance! What’s the story behind this?

By Wenser ( @wenser tahun 2010 )

As Coinbase’s official L2 network, Base has repeatedly stated that it will not issue a token. However, times have changed, and Base is now poised to make a move.

On the evening of September 15th, Jesse Pollak, head of the Base protocol, announced at BaseCamp that “Base is exploring the issuance of a network token.” Subsequently, Base officially released an announcement stating , “We are still in the early stages of exploration and have no specific information to share regarding timing, design, or governance. We are committed to engaging the community and building openly.” Coinbase CEO Brian Amstrong later confirmed the news in a post , stating that “this could be a powerful tool to accelerate decentralization and expand the growth of creators and developers within the ecosystem.”

Odaily Planet Daily will briefly analyze the internal and external motivations, interactive references, and token market capitalization of Base in this article.

Base broke his promise and became fat, just because the times have changed

In August 2023, Base officially launched its mainnet and experienced rapid growth in a short period of time. According to Data bukit pasir , as of September 13, 2025, the total number of Base network addresses reached 245 million, with protocol revenue reaching $157 million. On September 15, the Base network’s seven-day average of active addresses exceeded 1.018 million. On June 19 of this year, Base’s daily active addresses reached nearly 3.6 million, and the weekly active addresses reached 14.9 million.

Furthermore, Base ranks among the top L2 networks in terms of TVL. According to L2 Beat data , as of September 16th, the Base ecosystem’s TVL reached $15.91 billion (second only to the Arbitrum Network, which boasts a TVL of $20.11 billion). This includes $4.35 billion in bridge funding, $6.25 billion in native minting funding, and $5.31 billion in external bridge funding. The top three tokens by market capitalization on the Base network are:

- The stablecoin USDC has a capital scale of up to 4.048 billion US dollars;

- The scale of ETH funds is as high as 3.303 billion US dollars;

- cbBTC’s capital size reached US$2.302 billion.

Data Ketukan L2

Although the data is quite impressive, the Base ecosystem is far from reaching a stage where it can rest easy. It is no exaggeration to say that the Base ecosystem is currently facing both internal and external troubles.

Internal concerns of the Base ecosystem: inflated trading volume and TVL outflow

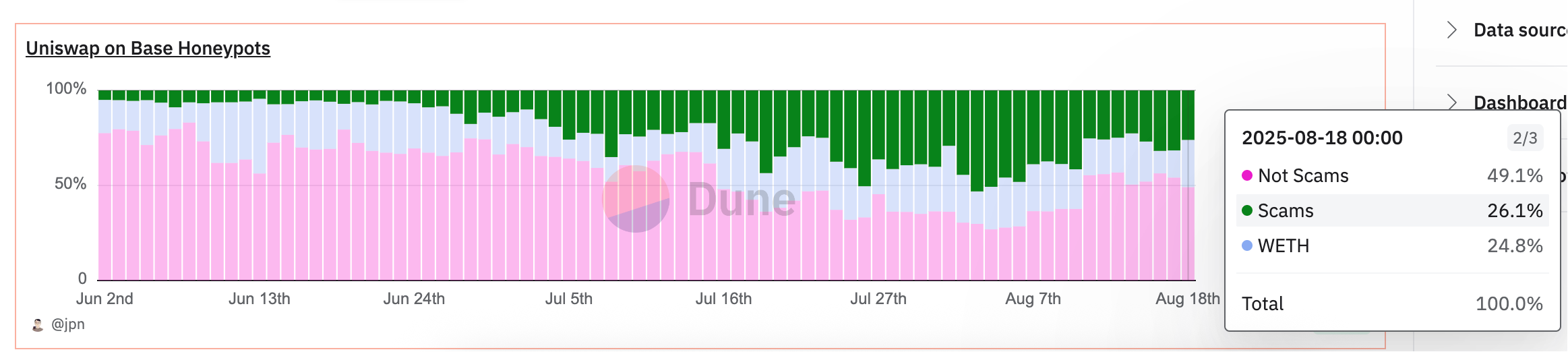

During last year’s meme coin craze in the Base ecosystem, on-chain analyst @jpn_memelord published an article revealing that 65%-80% of Uniswap’s trading volume in the Base ecosystem came from Rug funds.Data bukit pasir also shows that the Uniswap V3 liquidity pool in the Base ecosystem is controlled by a small number of addresses, with over 150,000 addresses creating liquidity pools, showing a high correlation with meme coins. Another Dune dashboard created by @jpn_memelord shows that as of August 18th of this year, 26.1% of the contract addresses in the Base ecosystem were still Pixiu (Phixiu) scams.

Selain itu, data menunjukkan bahwa the capital outflow of the Base network in the past three quarters has reached as high as US$4.6 billion, and the cumulative outflow for the whole year has reached US$5.7 billion. The other side of the increase in TVL is that a large amount of funds have flowed back from the Base ecosystem to the Ethereum main network ecosystem.

The external dilemma of the Base ecosystem: the exchange and public chain war re-emerges

As Coinbase’s Ethereum L2 network, Base still faces fierce external competition:

On the one hand, there is the rapid development of exchange public chains such as Binance’s BNB Chain, OKX’s X Layer, and Kraken’s Ink;

On the other hand, the collapse of the Ethereum L2 network narrative brought about the “ecological development pain period”, and many L2 networks embarked on the death spiral of “financing-coin issuance-ecological decline”, which also became a lesson for the development of Base.

In addition, Base’s main concept of Onchain Summer has also failed to attract more users. Most SocialFi and creator economy platforms such as Friend.tech, Farcaster, and Zora have gradually disappeared after experiencing a round of popularity and disappeared from the vision of mainstream market users.

Macroeconomic stimulus: US kripto-friendly regulatory policies

Combined with the macroeconomic changes such as the US government’s comprehensive shift to a “crypto-friendly” government since Trump took office, the SEC and CFTC opening the US market to overseas crypto exchanges, the relaxation of derivatives trading restrictions, and the SEC’s launch of “Project Crypto,” the previous restrictions on Base’s native token issuance have gradually loosened. Intense external competition and favorable regulatory policies have necessitated a more proactive approach to Base’s response and the search for new breakthroughs. Consequently, Base officials have shifted from their previously conservative stance to actively embrace a crypto-native development path, and are preparing to issue their ecosystem-native token.

Additionally, menurut to Jesse Pollak, head of the Base protocol, “Base will be launching a new bridge connecting Base and Solana. The goal of the bridge is to enable users to seamlessly build between Base and Solana using SOL, ERC-20s, and SPL tokens, thereby achieving:

- Deposit and use SOL in any Base application;

- Import any Solana token into the Base app;

- Users can export the created Base tokens to the Solana ecosystem.”

This also means that the Base ecosystem and the Solana ecosystem are fully integrated, becoming another crypto center in addition to the Ethereum ecosystem.

Base Pre-Issue Interactive Reference Guide: On-Chain Transactions, Onchain Score, Base Name

Currently, the exact timeline for Base’s token launch remains uncertain, with estimates ranging from the end of this year at the earliest to the first half of next year or even later. Therefore, for users not deeply involved in the Base ecosystem, while the official token airdrop plan hasn’t been announced, there’s still some value in engaging with it. Currently, there are three potential approaches:

1. Participate in on-chain transactions and interactions

Main platform: https://zora.co/

As an on-chain trading platform with strong support from the Base ecosystem and the official, Zora currently integrates multiple functions such as token creation, NFT trading, invitation rebates, and creator token trading.

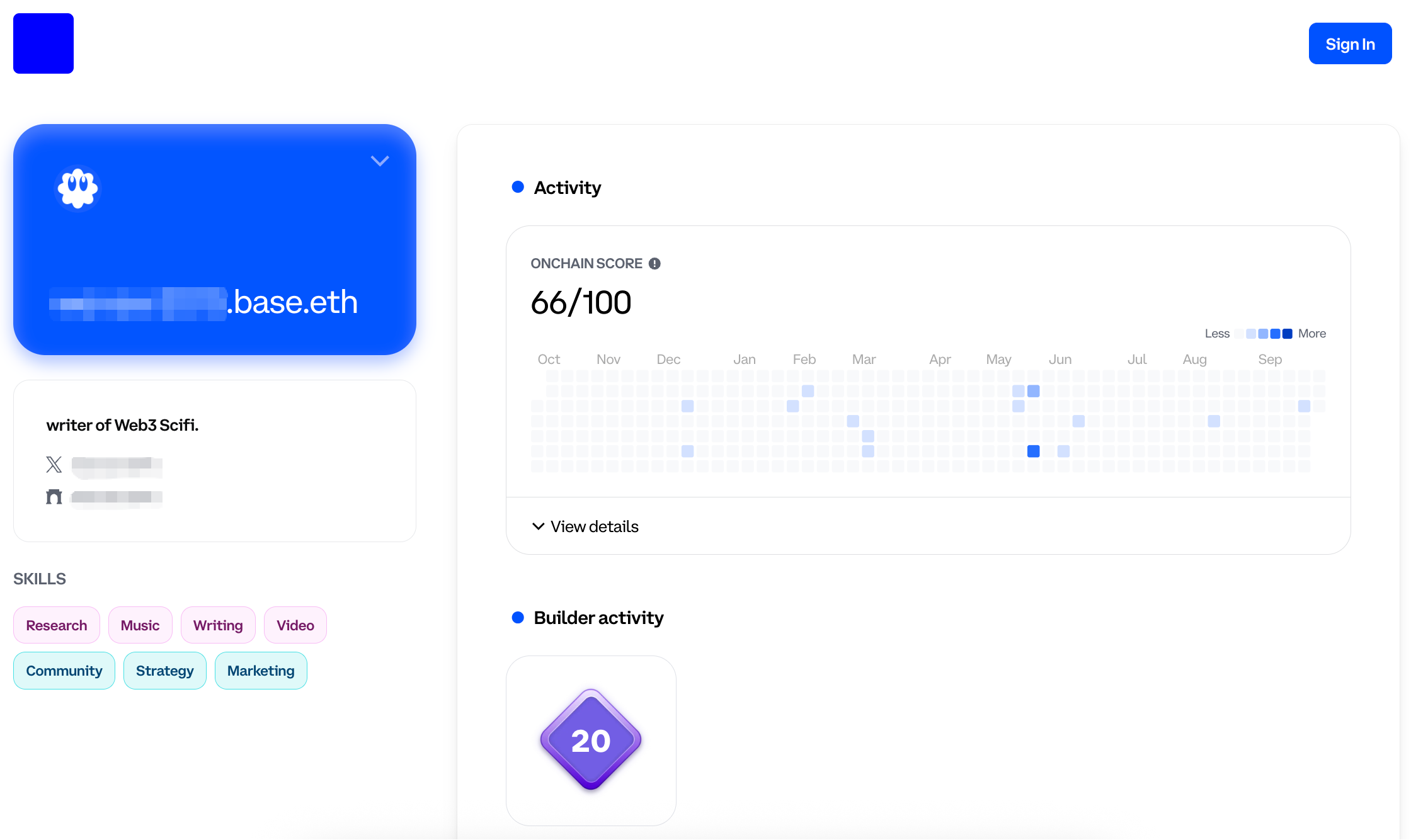

2. Onchain Score Query

Reference platform: https://www.onchainscore.xyz/

Menurut ke @Crypto_Pranjal , the website was launched by Coinbase CEO Brain Amstrong in August 2024. Users can view the “on-chain score” corresponding to the wallet address based on the information on the website to judge their level of participation in the Base ecosystem.

Its main assessment criteria include total transaction volume, unique usage days, longest continuous usage days on Base, exchanges, bridging, lending and borrowing, and deployed smart contracts.

3. Base Name (ENS Secondary Domain Name)

Registration platform: base.org/names

In addition to the two methods above, Base, a staunch supporter of the Ethereum ecosystem, previously launched an ENS-based second-level domain, xxx.base.eth. Users can register this domain to view address-related information and participate in related activities.

Selain itu, Base ecosystem’s DEX Aerodrome and SocialFi application Farcaster are also platform tools worth interacting with and using.

Basis Token Pasar Cap and Future Outlook

Finally, regarding the potential market size of Base’s upcoming token, the current market representative views are as follows:

1 confirmation founder: If operated properly, BASE is expected to become one of the top five tokens in terms of market capitalization

Nick Tomaino, founder of 1 confirmation (Odaily Planet Daily Note: It is worth mentioning that he is also an early member of Coinbase and has previously participated in Coinbase business development) menulis bahwa if Base issues tokens in the right way, it will be expected to immediately rank among the top five in market capitalization.

He suggested avoiding VC involvement and insider trading, and instead distributing tokens to developers and users through transparent airdrops, with criteria based on actual usage. Tomaino called Base the most successful tokenless blockchain in history, and airdrops a strong driver of its growth.

Jia Yueting: If Basecoin is launched, it may change the way cryptocurrency and traditional capital work together

Faraday Future founder Jia Yueting menulis bahwa if Base launches a token, it could change the way cryptocurrencies and traditional capital work together. With token support, Base could become the first secure bridge connecting publicly listed companies and crypto assets, a strategy that all major banks could emulate. As an asset class, cryptocurrencies could transition from being a “risk bet” to a “core business asset.”

In terms of capital flows, if this model proves true, trillions of dollars will flow into cryptocurrencies, and the entire L2 and blockchain valuation script will be rewritten. Regulation may become the final hurdle, but this is not just about tech finance, but also about Wall Street.

Conclusion: Coinbase will be the biggest winner after Base launched its token

There is no doubt that when Base issues its currency, the ultimate and biggest winner will still be Coinbase behind it.

On the one hand, Coinbase can leverage this to generate more protocol revenue, further enriching its cash flow. On the other hand, Coinbase can leverage the Base ecosystem to expand into more application scenarios, increasing market share while deeply penetrating the mainstream population, laying a solid foundation for user growth and liquidity growth. Furthermore, Coinbase can leverage the Base token and Circle’s stablecoin USDC to create a seamless ecosystem, achieving a “deep integration of traditional finance and decentralized finance,” and providing diversified channels and entry points for traditional financial markets to deeply participate in cryptocurrency and stock tokenization trading.

A “new golden age of encryption” belongs to the United States, and Base does not want to miss it.

Artikel ini bersumber dari internet: Coinbase’s L2 suddenly changes its stance on coin issuance! What’s the story behind this?Recommended Articles

“The White House is preparing to issue an executive order to punish banks that discriminate against crypto companies.” This news has been flooding the WeChat Moments recently. People who have been in the cryptocurrency industry for more than two years have to rub their eyes to confirm it after seeing this news, and exclaimed, “It feels like a lifetime ago.” However, just over a year later, Operation Choke Point 2.0 was fully implemented in March 2023. During the Biden administration, the Federal Reserve, the FDIC, the OCC, and other institutions issued a joint statement designating cryptocurrency businesses as “high-risk” and requiring banks to rigorously assess their exposure to crypto clients. Regulators, through informal pressure, forced crypto-friendly banks like Signature Bank and Silvergate Bank to close core businesses and restrict new…