A Panorama of USD1 Investment Opportunities: From Lazy “Lying Flat” to DeFi’s 45% Annualized Return StrategyRecommended

Author | Ethan ( @ethanzhang_web3)

In the blink of an eye, three months have passed since the USD1 airdrop. Looking back at that 47-coin airdrop, it feels like a foreshadowing, quietly kicking off the “family wealth story.” Last week, WLFI’s TGE launched with a bang, slashing the token price by half. The Trump family reaped a significant amount of traffic and capital.

But for ordinary users, beyond just watching the excitement, the more practical concern is how to increase the value of their wallets. If those 47 USD1 were to remain in the wallet, they might not even cover the mining fees. However, if they were to invest in CeFi or DeFi investment pools, they might have already hatched several “golden eggs.”

So the question is: What are you doing with your 47 USD1 coins now? Are you just sitting there, or are you working hard? Odaily Planet Daily has compiled some strategies for managing USD1 across CeFi, DeFi, and reward-based trading.

A Panorama of USD1 Financial Opportunities from the “47” tetesan udara

After continuous observation and community research, USD1 has been fully deployed on mainstream public chains such as Ethereum, Solana, Tron, and BNB Chain. It has also expanded into diverse yield scenarios in CeFi and DeFi, with an annualized return range of 1.7%–45% , suitable for users with different risk appetites. The following is a breakdown from several dimensions:

CeFi: The best capital protection channel for “lazy people”

Note: Binance Simple Earn APR is variable; HTX promotional limits apply (20% APY for deposits below 500 USD, up to 100% for new users).

Among centralized platforms, Binance Simple Earn is the “lazy person’s standard.” With a starting investment of just $0.1 USD, it boasts an annualized return of approximately 13.5%, no lock-up required, and daily interest accrual. Combined with occasional Yield Arena events, it’s like “automatically leveling up.”

HTX plays the “high-interest card”, with the annualized rate of the stablecoin zone reaching 20%, but this is a subsidy behavior, suitable for short-term wool-picking and not suitable for long-term reliance.

In addition, WLFI is promoting a USD1 points system across all platforms , covering exchanges such as KuCoin , HTX, Bybit, and Bank Tabungan Negara. Points can be accumulated by holding, trading, or staking USD1, which can be redeemed for airdrops, NFT, or other benefits in the future.

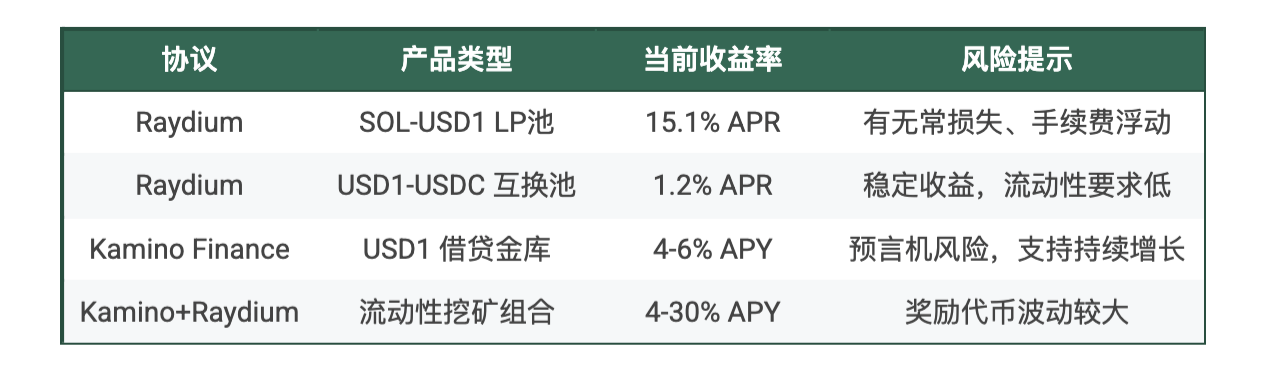

Solana Ecosystem: The Source of DeFi

Solana is the most profitable ecosystem for USD1 DeFi. The Raydium USD1-USDC pool offers a 1.2% annualized return with virtually no price volatility, similar to an on-chain Yu’e Bao. Raydium SOL-USD1 LP offers a 15.1% annualized return, but is subject to impermanent loss. The Kamino lending vault offers a 4–6% annualized return, no lock-up required, and is suitable for conservative holdings, with the added bonus of accumulating points. The Raydium + Kamino combined pool offers returns ranging from 4% to 30%, but is highly dependent on the reward token price and subject to significant volatility.

Ethereum: A hotbed of high-risk, high-reward strategies

Ethereum has always been a paradise for DeFi players, but risks and benefits coexist.

- Uniswap v3 USD1-WETH LP : 45% APR / 277% compound APY, impressive returns, but subject to impermanent loss. High fees in good times, but only stablecoins may remain when ETH prices surge.

- Uniswap v3 USD1-USDT LP : 2.6% APR, stablecoin pair, almost no price risk, more “retirement-oriented”.

- Aave v3 lending market (under preparation) : Expected annualized rate of return is 2%–6%, with overall risk being relatively controllable. It is more like a “serious financial product” and suitable for conservative investors.

Tron: Hidden risk of interest rate jump

Tron’s JustLend DAO offers a more extreme approach. Regular lending offers a low-risk, but limited return of approximately 1.74% annualized, similar to an on-chain demand deposit. Extreme utilization : When the pool is fully lent, the annualized return can soar to 72.9%. However, this situation is highly volatile, and the interest rate can plummet at any time. It might be 70% in the morning, but it could drop to single digits in the afternoon, so be aware of the risks.

Tron’s high returns rely entirely on its “interest rate jump model,” resulting in far greater volatility than Solana and Ethereum. While conservative traders might find it uninspiring, short-term speculators who diligently monitor the market may find a “high moment.”

Artikel ini bersumber dari internet: A Panorama of USD1 Investment Opportunities: From Lazy “Lying Flat” to DeFi’s 45% Annualized Return StrategyRecommended Articles

Related: Data Revealed: How Much Money Can MEV Bot Make from CEX-DEX Arbitrage?Recommended Articles

Compiled by Odaily Planet Daily ( @OdailyChina ); Translated by Azuma ( @azuma_eth ) How much profit can the MEV arbitrage robot make from CEX-DEX arbitrage? No one has been able to answer this question before, but we are excited to announce that a new paper has finally been published that uses a formal method to measure it (paper link: https://arxiv.org/abs/2507.13023 ), and I will summarize all the core findings of the paper for you in a series of pictures and explanations below. Super Concentrated Profits? Pretty good, but not as much as you might think ; Bot strategies vary, but the excess returns of top traders mostly decay within 0.5 to 2 seconds ; Pasar concentration is increasing, including in the field of block builders ; However, as competition…