The GENIUS Act passed the Senate. Is the United States moving towards becoming the capital of encryption?

Original author: Bright, Foresight News

On the afternoon of June 17, Eastern Time, the U.S. Senate passed the landmark kriptocurrency legislation, the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act), with 68 votes in favor and 30 votes against. The next step will be to submit it to the House of Representatives for deliberation. If it passes smoothly without amendments, it will soon be submitted to U.S. President Trump for signature and implementation. In fact, the House of Representatives does not need an absolute majority vote to approve it.

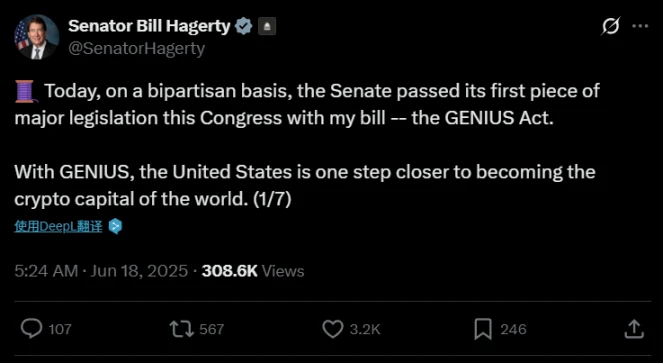

The GENIUS Act has a smooth road ahead after it passed the Senate. This is a historic lobbying victory for digital asset companies in the Senate鈥檚 first vote on comprehensive cryptocurrency regulatory reform. In the words of Tennessee Senator Bill Hagerty, who is also the core figure who proposed the GENIUS Act, that is, the United States is one step closer to becoming the capital of crypto.

A quick look at the core provisions of the GENIUS Act

The core provisions of the Act are as follows:

Mandatory 1:1 sufficient assets: including cash, bank current deposits, and short-term U.S. Treasury bonds. At the same time, misappropriation and re-pledge are strictly prohibited, and it is exclusively used for payment and settlement scenarios.

High-frequency transparency disclosure: The reserve fund composition and redemption policy must be disclosed regularly and audited by a certified public accounting firm for compliance.

Dual license system: Once the issuers stablecoin circulation market value exceeds US$10 billion, it must be transferred to the federal regulatory system within the prescribed period and adopt banking-level supervision. Below this amount, state-level supervision can be adopted, and small issuers can choose state-level registration (subject to federal equivalent standards).

Anti-money laundering compliance: Stablecoin issuers and their custodians will be subject to the Bank Secrecy Act and will fulfill financial institution-level AML obligations.

Clearly defined as a medium of payment: The bill clearly defines stablecoins as a new type of payment medium, which is primarily subject to the banking regulatory system rather than the securities or commodity regulatory system.

Recruiting existing stablecoins: The buffer period of up to 18 months after the bill comes into effect is intended to urge issuers of existing stablecoins (such as USDT, USDC, etc.) to obtain licenses or become compliant as soon as possible.

Then, the GENIUS Act will address the following historical issues.

Detailed explanation of the GENIUS Act: https://foresightnews.pro/article/detail/85338

The bipartisan debate in the United States

Bill Hagerty, a senator from Tennessee and one of the sponsors of the GENIUS Act, immediately expressed his gratitude for the passage of the bill. He said that the GENIUS Act established the first growth-friendly regulatory framework for payment stablecoins. The bill will consolidate the dominance of the U.S. dollar, protect customers, increase demand for U.S. Treasuries, and ensure that innovation in the field of digital assets is in the hands of the United States of America, not its adversaries.

By combining the strengths of the U.S. dollar with the speed and efficiency of blockchain technology, the GENIUS Act promotes the adoption of cryptocurrencies in the trade community and pioneers a new generation of payment processing. Once the GENIUS Act becomes law, corporations, small businesses, and individuals will be able to complete payments almost instantly, rather than waiting days or weeks and incurring the corresponding fees. In short, stablecoins are a paradigm-changing development that can bring our payment system into the twenty-first century.

The legislation establishes a process for issuing stablecoins, specifies clear roles for federal and state regulators, imposes consumer protection standards, and contains strong safeguards to deter illegal activity. Projections show that with the passage of the GENIUS Act, stablecoin issuers will become the worlds largest holders of U.S. Treasury securities by 2030. Such an outcome would enhance fiscal resilience and solidify the dollars position as the global reserve currency.

U.S. Treasury Secretary Scott Bessent published a statement at a critical time to support the GENIUS Act, saying that the stablecoin market is expected to grow to $3.7 trillion by the end of this decade. Bessent said that the stablecoin ecosystem backed by U.S. Treasuries will drive private sector demand for U.S. Treasuries, which is expected to reduce government borrowing costs and help control national debt. He believes that this is a win-win innovative legislation that will benefit the private sector, the Treasury Department and consumers, while helping more users around the world enter the dollar-based digital asset economy.

However, the day before, Elizabeth Warren, a well-known Democratic crypto hawk and senior Democratic member of the U.S. Senate Banking Committee, remained tough. She pointed out that there is a major loophole in the GENIUS Act that allows big tech companies and large retailers to issue their own private currencies and structure them as stablecoins. If Congress does not amend the GENIUS Act, billionaires such as Elon Musk and Jeff Bezos will launch stablecoins, track your shopping behavior, use your data, and squeeze out competitors.

In fact, in the GENIUS Act case, Democratic senators represented by Elizabeth Warren have always been the main force hindering the progress of the GENIUS Act. It was also due to the collective opposition of Democratic senators that the GENIUS Act failed to advance further in the Senate vote on May 8 because it only received 49 votes (which did not meet the minimum requirement of 60 votes).

The reason why some Democrats finally switched sides was because the demands of Elizabeth Warrens faction were met. According to NBC reports, representatives of the two parties reached an agreement through negotiations. In exchange, the bill added some amendments, including changes to consumer protection measures and restrictions on the issuance of stablecoins by technology companies, and extended ethical standards to special government employees. At present, large technology companies are subject to many restrictions on the issuance of stablecoins. First, it is necessary to set up a regulated subsidiary to specialize in stablecoin business. Second, it is necessary to accept the same prudent supervision as financial institutions. Third, data privacy standards must be strictly observed, which to a certain extent eliminates the risk of large technology companies using ecological monopolies to launch shadow currencies.

Where is Tether headed?

Tether (USDT), currently the worlds largest stablecoin issuer, may become the first and largest victim of the GENIUS Act.

Currently, only about 85% of USDT is backed by cash and cash equivalents, which does not meet the mandatory requirement of 1:1 cash and cash equivalents. Its auditing agency BDO Italia does not meet the standards of the US Public Company Accounting Oversight Board (PCAOB), making it even more difficult to be recruited by the US system.

At the same time, Tethers headquarters has moved to El Salvador, seeking political asylum from the cryptocurrency-friendly President of El Salvador. Tether CEO Paolo Ardoino once hinted that the original USDT may no longer enter the US market directly, but will launch a settlement stablecoin branch that complies with the GENIUS Act system. However, in markets other than the United States, the originally dominant USDT business cannot be easily abandoned.

Therefore, the impact of the GENIUS Act is currently more focused on the United States, and its greater role is to set a benchmark in the field of crypto regulation. The traditional stablecoin market will not disappear immediately. However, with the evolution of compliance, compliant stablecoins will surely become mainstream in the future. The 600% increase in Circles 10 days after its listing may just be the beginning of the stablecoin blue ocean.

This article is sourced from the internet: The GENIUS Act passed the Senate. Is the United States moving towards becoming the capital of encryption?

CEX popular currencies CEX top 10 trading volume and 24-hour rise and fall: BNB: 0.70% BTC: 2.27% ETH: 1.13% SOL: 2.19% KAITO: 24.01% EOS: 17.95% LAYER: -27.22% DOGE: 3.61% SUI: 5.14% HIGH: 20.75% 24 H increase list (data source: OKX): DUCK: 34.08% ETHFI: 13.64% PENGU: 13.48% MOODENG: 13.47% PIXEL: 12.73% MERL: 12.40% KAITO: 12.09% GOAT: 11.89% BCH: 10.97% DEGEN: 10.65% 2. Top 5 popular memes on the chain (data source: GMGN ): POPCAT Fartcoin mog/acc KMNO AGI 3. 24-hour hot search currencies Mikami: Mikami is a meme coin issued by the famous Japanese artist Yua Mikami on the Solana chain on April 30, 2025. The total supply is 69 million, 50% of which is held by Yua Mikami and locked until 2069, 20% for pre-sale, 15% for liquidity, 10% for…

Bagus sekali