A new round of reciprocal tariff war: Why is the world accelerating its embrace of cryptocurrency?

On May 12, the Sino-US Geneva economic and trade talks exceeded expectations, and US stocks and cryptocurrencies rose under favorable policies and market expectations. However, the ruling of the US International Trade Court at the end of the month weakened the legitimacy basis of the tariff war, triggered policy games, and the reconstruction of global trade rules entered the judicial-administrative wrestling stage. There are still concerns about the long-term impact of tariffs. Crypto assets are decentralized, cross-sovereign, and resistant to policy intervention, which are increasingly favored by investors.

On May 12, the Sino-US Geneva economic and trade talks exceeded expectations, and US stocks and cryptocurrencies rose under favorable policies and market expectations. However, the ruling of the US International Trade Court at the end of the month weakened the legitimacy basis of the tariff war, triggered policy games, and the reconstruction of global trade rules entered the judicial-administrative wrestling stage. There are still concerns about the long-term impact of tariffs. Crypto assets are decentralized, cross-sovereign, and resistant to policy intervention, which are increasingly favored by investors.

The US government tasted the sweetness of economic data in May: the latest non-farm payrolls data for April increased by 177,000, better than expected, indicating that the labor market remains robust. The tariff suspension period agreement reached at the Sino-US trade talks in Geneva eased market concerns about the disruption of the global supply chain. Consumers inflation expectations for imported goods (such as electronic products and daily necessities) declined, driving the recovery of retail consumption willingness, thus bringing a more impressive confidence index: data released by the Conference Board on the 27th showed that the US consumer confidence index unexpectedly soared to 98 in May, a sharp rebound of 12.3 points from 85.7 in April, the largest monthly increase in four years, showing the positive transmission of tariff easing to the consumer end.

However, good fortune never comes in pairs, and the bitterness of US debt has also been delivered to the mouth. After the opening of Trump 2.0, the huge shock in the US debt market has become commonplace. In late May, the yield on 30-year US bonds soared to more than 5.1%, close to the highest level in 20 years. There are a series of factors that affect the trend of US bonds, such as Japanese bonds and the progress of trade negotiations, but in fact, we all know that the US fiscal outlook is the most critical, and new variables have appeared: At the end of May, the Trump administrations One Big Beautiful Bill Act (we will continue to analyze below) was passed by the House of Representatives, proposing to increase the US debt ceiling from the current $10,000 to $40,000. The New York Times cited a forecast showing that the bill will push the US debt-to-GDP ratio from the current approximately 98% to 125%. The bill is currently awaiting Senate review.

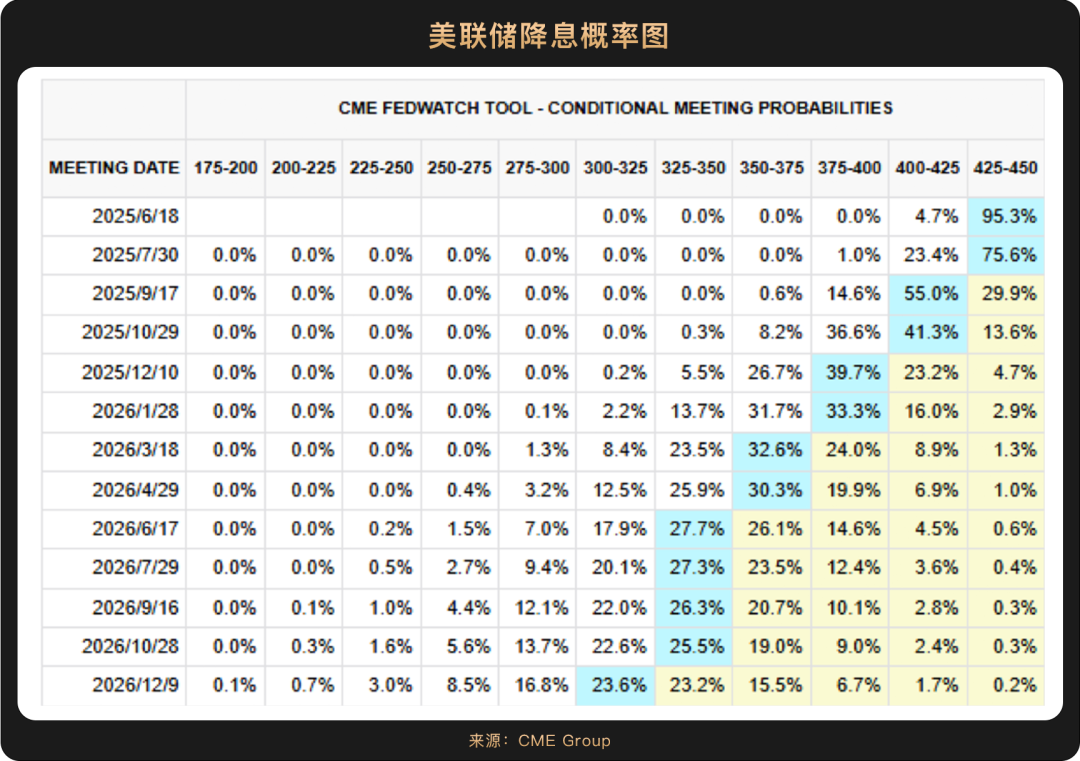

In addition, the Feds interest rate cuts remain unclear. The minutes of the Feds May meeting released on May 28, 2025 showed that almost all of the 19 officials participating in the Feds policy meeting believed that inflation may be more persistent than expected, so the Fed maintained its position of suspending interest rate cuts.

In general, the current US economy is in a stage of stability with risks: short-term growth resilience supports the market and is good for the US dollar, but the broader fiscal and monetary policy background may suppress its upside. In the future, how the Senate will revise the Beautiful Bill (such as the scale of tax cuts and the intensity of spending cuts), as well as other conditions in the signing process, will also have an impact on the US economic structure and global financial markets. Whether the contradiction of the US policy of stimulating short-term growth and overdrawing long-term credit can be alleviated remains a mystery.

There is a saying on Wall Street that Sell in May, but the easing of reciprocal tariffs in early April broke this curse. The U.S. stock and kripto markets quickly cleared the negative pricing of the reciprocal tariff war, and the speed and magnitude exceeded expectations. The SP 500 index rose by about 6.15% for the whole month, the Nasdaq rose by about 9.56%, and the Dow Jones rose by about 3.94%. The SP 500 and Nasdaq recorded their strongest May performances since 1990 and 1997, respectively, directly reflecting the markets optimistic expectations for supply chain repairs and improved corporate profits:

The phased agreement between China and the United States on May 12 directly boosted market risk appetite. On that day, the three major U.S. stock indexes soared across the board, with the Dow Jones Industrial Average soaring 1,160 points (2.81%), the SP 500 up 3.26%, and the Nasdaq up 4%, the largest single-day increase since 2024. Technology giants have become the biggest beneficiaries, with Amazon (AMZN) and Meta (META) rising by more than 7% in a single day, and Nvidia (NVDA) and Apple (AAPL) rising by more than 6%. After the tariffs were eased, institutions such as Goldman Sachs raised their expectations for U.S. stocks, raising the target point of the SP 500 for the next 12 months to 6,500 points, emphasizing that the possibility of a soft landing has increased. However, another view is that the rise in U.S. bond yields may squeeze corporate profit margins, especially technology companies that rely on a low-interest environment. This long-short game has led to the market showing the characteristics of high volatility and high differentiation.

Even more controversial is the Beautiful Bill pushed by the Trump administration. The bill involves multiple areas such as taxation and immigration, and is intended to push the US debt-to-GDP ratio from the current 98% to 125%, far exceeding the international warning line (90% is generally considered to be the debt risk threshold), exacerbating market concerns about the credit risk of US debt. Moodys also downgraded the US sovereign credit rating from Aaa to Aa 1 this month.

The bill claims to cover the increase in debt through tax reform, boosting expectations for a soft landing of the economy in the short term, but the market generally questions the fiscal sustainability of the United States – the U.S. federal fiscal deficit reached $1.147 trillion in the first five months of fiscal year 2025, an increase of 38% year-on-year. Tax growth faces resistance, and the debt snowball effect may be difficult to curb. In an interview with CBS, Musk publicly stated that he was disappointed with the bills increase in deficit, while the Democratic Party accused it of undermining government efficiency. In the subsequent Senate review process, possible revisions (such as a reduction in the scale of tax cuts) and the uncertainty of the presidents signature will become potential core factors suppressing market risk appetite.

In short, the current core issue in the market has shifted from liquidity and interest rate cuts to U.S. bonds, and the Trump risk is always online.

As a bellwether of digital assets, Bitcoin broke through $100,000 in April and staged a counterattack show in May – it soared from the oscillation range of $95,000 at the beginning of the month to $105,000 at the end of the month, with a monthly increase of 12%. During this period, it once reached $112,000, refreshing the high point since April 2024, which greatly reversed the markets inherent perception of it as a high-volatility risk asset. With the tariff war entering a new stage, this resonance effect with the U.S. stock market (the Nasdaq index rose 9.56% during the same period) means that investors are re-anchoring assets amid policy uncertainty.

In such a market atmosphere, Bitcoins own fundamentals have also ushered in key catalysts, and the siphon effect at the capital level is particularly significant: according to data compiled by Bloomberg, in the past five weeks, the US Bitcoin ETF has attracted more than US$9 billion in capital inflows. At the same time, gold funds have suffered more than US$2.8 billion in capital outflows. It can be seen that some investors are abandoning traditional gold and turning to Bitcoin, known as digital gold, and regard it as a new value storage and hedging tool. The investment trend has changed significantly.

Among them, BlackRocks internal investment portfolio BlackRock Strategic Income Opportunities Portfolio continues to increase its Bitcoin ETF (IBIT) size. Currently, IBITs asset management scale exceeds US$72 billion. Although it was only launched last year, it has ranked among the worlds 25 largest Bitcoin ETFs. From a more macro perspective, the rapid development of IBIT reflects that cryptocurrencies are accelerating their integration into the mainstream financial system. On the 19th, JPMorgan Chase announced that it would begin to allow customers to invest in Bitcoin, although its CEO Jamie Dimon remained skeptical. We will allow customers to buy Bitcoin, Dimon said at the banks annual investor day event on Monday. We will not provide custody services, but will reflect the relevant transactions in customer statements. This decision is a significant move for the largest bank in the United States, and it also marks the further integration of Bitcoin into the mainstream investment field, which may prompt institutions such as Goldman Sachs to follow suit.

The current trend of loosening crypto regulation in the United States has also brought about a positive new climate. On May 12, Paul S. Atkins, the new chairman of the U.S. Securities and Menukarkan Commission (SEC), delivered a keynote speech at the Crypto Task Force Tokenization Roundtable, proposing the goal of the United States to build a global cryptocurrency capital and announcing that the SEC will shift its regulatory model from enforcement-led to rule-led. More specifically, the SEC is considering three key reforms – clarifying the identification standards for security tokens, updating custody rules to allow self-custody under certain conditions, and establishing a conditional exemption mechanism for new products, etc., which means providing a clearer legal framework for crypto market participants, reducing uncertainty, and promoting innovation.

In addition to the direct promotion of funds and supervision, policy breakthroughs in the field of stablecoins have injected new impetus into the pricing logic of Bitcoin. On May 19, the U.S. Senate passed the Guidance and Establishment of a National Innovation for Stablecoins in the United States Act (hereinafter referred to as the GENIUS Act) by a procedural vote with 66 votes in favor and 32 votes against, marking the implementation of the first federal regulatory framework for stablecoins in the United States, which will reshape the U.S. crypto asset market and affect the global financial system. Just two days later, the Hong Kong Legislative Council passed the Stablecoin Bill on May 21, which is expected to take effect within the year, showing Hong Kongs breakthrough progress in the field of stablecoin regulation. The two bills form a synergistic effect and jointly promote the standardization of the global stablecoin market. On the one hand, it brings new funding channels to the digital currency market, and on the other hand, it provides institutional support for the development of the Web3 ecosystem. With the dual entry of traditional financial institutions + regulatory system, the narrative of real asset on-chain (RWA) is accelerating, and the market consensus on Bitcoin as a value storage base will be further strengthened, and its unique position in global asset allocation will become more prominent.

It is also worth looking forward to that in the future, the volatility of traditional financial markets will not form a one-way suppression on cryptocurrencies, but will instead become a boost to their rise at a specific stage: in the short term, the rise in U.S. Treasury yields has triggered market concerns about the U.S. fiscal situation, prompting safe-haven funds to flow into the crypto market; from a long-term perspective, the deterioration of the U.S. fiscal situation may enhance the safe-haven appeal of crypto assets. This fiscal pressure may undermine confidence in the U.S. dollar and Treasury bonds, prompting investors to turn to decentralized assets such as Bitcoin to hedge credit risks.

The cryptocurrency carnival in May means that when the traditional financial system is struggling with tariff frictions, debt crises, and monetary policy dilemmas, Bitcoin is becoming a new choice for capital to hedge against the uncertainty of the old order. As regulatory relaxation moves from expectations to implementation, this reconstruction process may accelerate. Of course, the mid-term suppression of U.S. Treasury yields, repeated regulatory policies, etc. may all pose a test to this round of gains. But in any case, Bitcoins digital gold narrative has entered the mainstream topic framework.

This article is sourced from the internet: A new round of reciprocal tariff war: Why is the world accelerating its embrace of cryptocurrency?

Related: Wintermute CEO says: Pasar makers are not the new “bad guys”, people need someone to blame

Compiled edited by TechFlow Guests: Evgeny Gaevoy, Founder and CEO, Wintermute host: Haseeb Qureshi, Managing Partner, Dragonfly Robert Leshner, CEO and Co-founder of Superstate Tom Schmidt, Partner, Dragonfly Podcast source: Unchained Original title: Crypto Market Makers EXPOSED: Inside the $ 38 M Move Token Dump – The Chopping Block Air Date: May 11, 2025 Summary of key points $38M Token Sale Exposed: Movement Labs’ Deal with Web3 Port Reveals the Dark Side of Crypto Market Making. Market Makers or Exit Liquidity? — An in-depth analysis of an incentive mechanism that allows market makers to sell tokens and share profits with the foundation. VCs turn a blind eye — Why top investors backed Movement Labs despite obvious risks, and what it means for cryptocurrency due diligence. Rushi Fired – Movement Labs…