WLD Surges 40% in a Single Day, Stirring Waves in the Digital Identity Sector

This rally was not triggered by technical patterns or liquidity anomalies. What truly ignited market sentiment was a rumor concerning OpenAI. The reason this rumor provoked such a dramatic response lies not in the “collaboration” itself, but in how it struck a chord with a reality being repeatedly validated: as AI becomes capable of mass-producing accounts that “act like humans,” how will the internet re-establish the existence of real people.

Not Another Social Platform, but an Attempt at a Foundational Logic

According to Forbes citing anonymous sources, OpenAI currently has a small team of fewer than 10 people internally, advancing a social networking project still in its early stages. Unlike existing platforms, this product does not attempt to innovate on content formats or interaction mechanisms; its core focus is singular: how to re-establish a credible boundary for “real users” in a context where AI saturates cyberspace.

The report indicates that OpenAI is evaluating various “real human identity verification” solutions, including Worldcoin’s Orb iris-scanning device and Apple’s Face ID technology. The goal is not traditional real-name verification or account binding, but to verify a more fundamental question—does this account correspond to a real and unique human individual.

If this direction holds true, it signifies that OpenAI is not merely building a new social application, but attempting to introduce a completely new foundational premise for social networking in the AI era.

Why Worldcoin Became the First Object of बाज़ार Association

Worldcoin’s repeated mention is no coincidence. One of the project’s co-founders is Sam Altman, the co-founder and CEO of OpenAI. Although his primary focus remains on OpenAI, this connection makes it difficult for the market to view Worldcoin as an “unrelated third-party solution.”

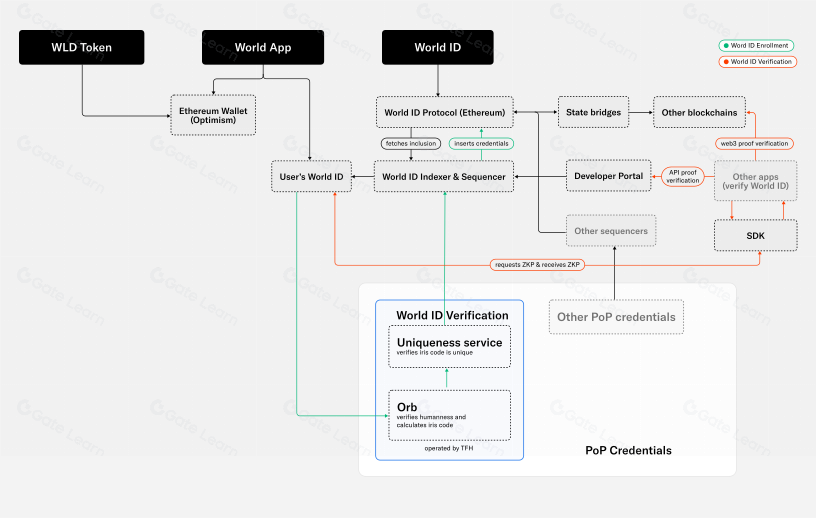

From its inception, Worldcoin was not just a token project but an attempt to build a global “proof of unique humanness” system. This goal seemed超前甚至激进 in the early days, but after the widespread adoption of generative AI, it has begun to show practical significance.

This is precisely why, when interpreting this rumor, the market’s focus is not merely on “whether there is cooperation,” but on whether OpenAI has already begun seriously considering the identity layer issue, and whether Worldcoin happens to be positioned at the intersection of this problem.

After AI Proliferation, Social Networks Are Losing the Boundary of “Human”

In the past, fake accounts were mostly low-quality bots or marketing spam, with relatively low identification costs. However, after the maturation of generative AI, the situation has undergone a qualitative change. Today’s fake accounts can simulate emotions, opinions, and behavioral rhythms, participate in public discussions, create illusions of consensus, and even exert substantial influence on financial markets and public opinion direction.

The traditional response has been real-name verification or KYC, but this path also has obvious problems. On one hand, it requires users to surrender vast amounts of private information; on the other, it turns platforms into highly centralized data nodes, simultaneously increasing privacy risks and regulatory pressure.

Against this backdrop, “proof of real human identity” is being re-examined. It does not attempt to answer *who* you are, but verifies only one thing: whether you are a real, existing human being, and one that exists only once.

Iris Scanning vs. Face ID: The Difference Between Two Approaches

Worldcoin’s Orb device scans the iris to generate an irreversible क्रिप्टोgraphic identifier, the World ID. The project emphasizes that raw biometric data is not stored; instead, it is converted into a mathematical proof used to ensure “one person, one account.”

The advantage of this method lies in its极强的唯一性. Iris structure is highly complex and theoretically almost impossible to replicate, making it more suitable as a foundational verification for “unique humanness.”

In contrast, Face ID’s advantage lies in its普及性. Hundreds of millions of users already employ this technology daily, with an extremely low barrier to entry. However, questions remain regarding whether it can meet the needs of being a cross-platform, non-repeatable registration, long-term identity layer infrastructure.

This is precisely the core divergence behind the two approaches: the trade-off between convenience and uniqueness.

WLD’s Surge: What Expectation is the Market Trading?

WLD’s rapid rise is essentially not trading on a piece of news, but on a possibility. If the AI era truly requires a new identity standard, then the solution first adopted by mainstream platforms will naturally possess strong network effects.

Once a digital identity becomes infrastructure, it is difficult to replace. Unlike ordinary applications that can be easily migrated, it creates long-term lock-in within an ecosystem.

From this perspective, the market is not betting that Worldcoin will definitely succeed, but rather on whether it has a chance to enter the ranks of “standard candidates.”

Regulatory and Practical Issues Remain

Of course, this path is not easy. Worldcoin has already faced biometric data regulatory scrutiny in multiple countries, with Orb device promotions suspended in some regions. The deployment costs, speed, and global coverage capabilities of physical devices are unavoidable practical challenges.

For OpenAI, whether it is willing to deeply engage with a global identity layer system also involves complex political, legal, and social considerations.

This WLD surge may recede as sentiment cools, but the problem it points to will not disappear. As AI begins to participate in internet activities like humans, proving “who is real” will no longer be a philosophical discussion but an engineering problem that must be solved.

Whether Worldcoin becomes the answer remains unknown, but one thing is certain: digital identity is transitioning from a peripheral topic in the crypto world to a core proposition of the AI era.

यह लेख इंटरनेट से लिया गया है: WLD Surges 40% in a Single Day, Stirring Waves in the Digital Identity Sector

Related: Tiger Research: Top 10 Changes in the Cryptocurrency Market in 2026

1. Institutional capital continues to remain in Bitcoin Source: Tiger Research With institutions dominating the market, capital flows have become more cautious. These investors are avoiding unverified assets, limiting their focus to Bitcoin and Ethereum. This trend is likely to continue. Market growth will concentrate solely on assets that meet institutional criteria. 2. Unprofitable projects face market elimination. Source: Tiger Research The fact that 85% of new tokens saw their prices fall after TGE exposes the limitations of narrative-driven growth. Projects based on hype will be replaced by new trends at an increasingly rapid pace. The market will shift towards projects that generate real returns and demonstrate solid fundamentals. 3. If it fails in terms of practicality, repurchase is the only solution. Source: Tiger Research Utility-focused token economics has failed.…