A terrifying night of crashes: a record high of $13.5 billion in single-day liquidations, with wealth flowing wildly

Author | Dingdang ( @XiaMiPP )

At 5 a.m., the market collapsed.

Last night, Trump announced that he would impose a 100% tariff, which would be added to the existing tariffs . This news was like a lit fuse, detonating the market and causing the panic index to soar.

बीटीसी once fell below $102,000, hitting a low of $101,516, with a 24-hour drop of 16% ; ETH hit a low of $3,400, with a 24- hour drop of 22% ; प fell below $150, hitting a low of $141.3, with a 24-hour drop of 31.83% .

If mainstream क्रिप्टोcurrencies are in such a state, the situation for altcoins is even worse. IP, for example, plummeted from a low of $7.8 to around $1 within an hour, a drop of 87%. It has temporarily rebounded to $4.8. PUMP, on the other hand, plummeted from a low of $0.00488 to $0.000411 before recovering to $0.00385.

Binance’s staking products, WBETH and BNSOL, were also affected. WBETH plummeted to a low of $430.65, a drop of over 800%, while BNSOL plummeted from $213 to $34.9, a drop of over 500%. Even स्थिर सिक्के were not spared. USDE briefly hit $0.65, depreciating by 54%, before recovering to around $0.96.

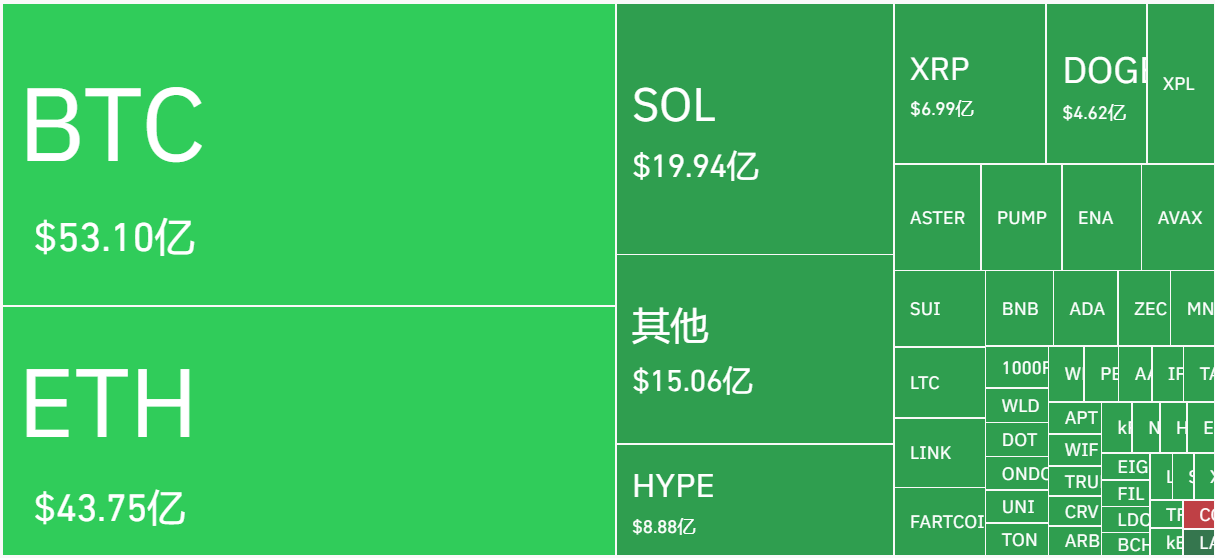

The derivatives market was the most visible amplifier of this collapse. Coinglass data shows that over the past 24 hours, 1.6 million people worldwide experienced margin calls, totaling $19.13 billion, the highest single-day liquidation ever . This included $16.679 billion in long positions and $2.454 billion in short positions. The largest single liquidation occurred in Hyperliquid’s ETH-USDT exchange, valued at approximately $203 million.

This time, it is an all-round and indiscriminate sweep of the entire crypto market.

Initially, everyone thought it was a normal minor pullback. After all, just a week earlier, BTC had broken through $126,000, reaching a new all-time high. Standard Chartered Bank raised its forecast to $135,000 in a report, while JPMorgan Chase was even more optimistic, pointing to $165,000.

No one expected that such a high point would become the starting point of the abyss.

Magic operation – escaping the top with a clear card

Even in this market situation, there is no shortage of god-level operations.

Yesterday, a Bitcoin whale increased its short positions on BTC and ETH, bringing its total position to over $1.1 billion. Currently, on-chain data shows that its position has been completely liquidated, withdrawing $60 million from the Hyperliquild platform. According to on-chain analyst Lookonchain, this OG may be connected to Trend Research, a firm under Yi Lihua.

In fact, Yi Lihua himself has indeed expressed his “bearish” stance on social media many times in recent days.

According to on-chain analyst Lookonchain, Trend Research has deposited 145,000 ETH into exchanges since October 3rd, worth approximately $654 million at the time. As of October 5th, only 7,163 ETH remained on the exchange. A rough estimate suggests the firm has profited as much as $303 million on ETH this round.

निष्कर्ष

Just 2 hours are enough to rewrite the fate of many market participants.

Some people became a speck of dust in the $13.4 billion margin call, while others caught the $60 million opportunity bounty from the collapsing building.

Most of the targets are recovering from the bottom 2 hours ago, while some currencies are “taking the opportunity” to flatten out. Odaily will continue to follow up as soon as possible.

यह लेख इंटरनेट से लिया गया है: A terrifying night of crashes: a record high of $13.5 billion in single-day liquidations, with wealth flowing wildlyRecommended Articles

Compiled and edited by Janna and ChainCatcher This article is written by Cosmo Jiang, General Partner and Portfolio Manager at Pantera Capital. Digital asset investing has long passed the stage of simply hoarding coins and waiting for appreciation. Digital asset treasuries (DATs), with their unique strategy of increasing net asset value per share and earning more in underlying tokens, have become a hot commodity for institutions. Pantera has invested $300 million in DATs, while BitMine has become a star performer thanks to its ETH reserves. This article will decipher the value of DATs, explore the underlying reasons why leading industry institutions are choosing this sector, and understand the new trends in digital asset investment. (1) Digital Asset Treasury (DATs) Investment Logic Our investment rationale for DATs is based on a…

抱抱你