Lazy Financial Management Guide | Deposit USDC and earn 17%+ income; Don’t miss the SyrupUSDC limit incentive pool (June

मूल | ओडेली प्लैनेट डेली ( @ओडेलीचाइना )

लेखक: अज़ुमा ( @अज़ुमा_एथ )

This column aims to cover the low-risk return strategies based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be ruled out) to help users who hope to gradually increase the scale of funds through U-based financial management to find more ideal interest-earning opportunities.

पिछले रिकॉर्ड

New opportunities

Falcon assets are listed on Euler

Last week, the lending protocol Euler Finance announced that it has supported a basket of Falcon Finance assets including USDf, sUSDf, PT‑sUSDf, etc. Since the yields of Falcon Finance assets are generally higher than the market base interest rate (introduced in the two issues on April 7 और 6 मई ), the introduction of the lending mechanism has opened up opportunities for users to further amplify their returns by using revolving loans.

Users who are familiar with revolving loans (especially PT revolving loans) can start operating immediately to pursue higher returns; users who are not familiar with or unwilling to bother can choose to provide USDC as lender. Currently, under the incentives provided by Euler Finance, the APY of providing USDC can reach 17.84% , which is a pretty good rate of return.

SyrupUSDC is now available on Solana

Earlier this month, SyrupUSDC, the interest-bearing stablecoin issued by institutional lending protocol Maple, was officially deployed to Solana.

Although the yield of SyrupUSDC itself and its Pendle-related pools is already ideal, after expanding to Solana, we can find some places with higher yields. For example, currently depositing SyrupUSDC in Exponent (Solana’s version of Pendle, which has been introduced many times) can earn a yield of 18.05% under Maple’s incentives.

It is worth mentioning that the pool is limited to 2 million US dollars, so interested users are advised to participate as soon as possible.

Unitas Mining

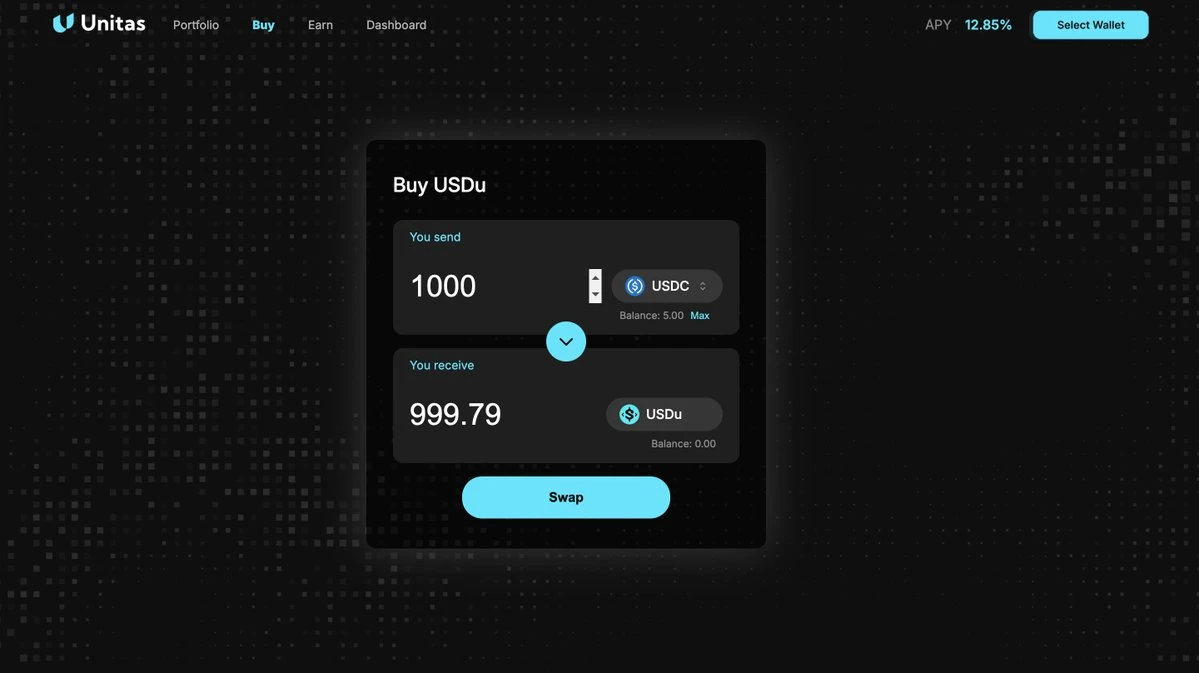

On June 10, Unitas, a stablecoin project spun off from Unipay, was officially launched.

Unitas allows users to mint stablecoin USDu and pledge it to generate income (it takes 7 days to unstake it). Its interest-bearing model is similar to Ethenas spot-futures arbitrage, and the current real-time APY is 12.85%.

Overall, the project is still in its early stages, and its rate of return is not bad, so it can be ambush with small funds.

Mirage protocol launches the first phase of mainnet

Another stablecoin project that needs attention is Mirage Protocol on Movement, which has received $1.6 million in financing from Robot Ventures, Selini Capital, Ambush Capital and Aptos co-founder Mo Shaikh (now resigned).

The project has launched the first phase of the mainnet today, opening up a mUSD minting quota of $500,000.

However, the overall webpage of mirage protocol is still relatively simple, and the yield situation is not currently displayed, so except for users who want to occupy the pit early, it is recommended to wait and see for now.

This article is sourced from the internet: Lazy Financial Management Guide | Deposit USDC and earn 17%+ income; Don’t miss the SyrupUSDC limit incentive pool (June 24)

संबंधित: मैट्रिक्सपोर्ट बाज़ार Observation: BTC consolidates at high levels after reaching $110,000, with institutions and ETFs becom

Last week (May 20-May 26), BTC price had insufficient momentum after reaching $110,000 several times, and quickly pulled back to enter a high-level consolidation phase. From May 21 to 23, BTC reached a strong peak, breaking through the important psychological barrier of $110,000, and hit a new high of $111,980 before a slight pullback. Subsequently, due to the significant weakening of bullish momentum, BTC failed to hit $111,000 several times, and the price quickly entered a range of shocks and consolidation. As of May 27, the BTC price stabilized at around $109,741, with the largest increase of 7.48% during the week. Last week, ETHs trend was basically consistent with BTC. Affected by Trumps dinner and concerns about the tariff war between Europe and the United States, the trading volume increased…