Behind the surge in Hong Kong stock market fan strategy: Memelands parent company changed its name through a backdoor li

Autor original: TechFlow

There is Micro Strategy in the West and Mi Strategy in the East?

On June 16, the share price of MemeStrategy, a Hong Kong-listed company, soared 25% and then began to fall.

The name of this newly renamed company is strikingly similar to that of the US-listed company, Bitcoin giant MicroStrategy, and even the style of its logo is exactly the same.

Its hard to say that this is a coincidence; it seems more like a deliberate imitation and following.

MicroStrategy has gradually increased its holdings of Bitcoin since 2020, and its stock price has hit new highs due to the cripto investment boom. MiStrategy announced today that it has purchased 2,440 SOLs and plans to allocate Bitcoin.

However, there is a detail here—the previous name of Micro Strategy was Haoliang Technology Holdings. This wave of operations is a combination of announcing the purchase of SOL + changing the companys name. Its intention is also very obvious. Through the backdoor name change and the brand effect of close to Micro Strategy, it intends to take advantage of the crypto asset craze and attract speculative funds.

Currently, the market regards it as Hong Kongs first meme stock. However, this high-profile naming strategy is far from simple as it seems. The capital operations and past records of the team behind it hide a deeper story.

Board of Directors and Equity Restructuring, 9 GAG Team Joins the Game

The name change and transformation of Mi Strategy began on April 1, 2025.

According to Hong Kong media Sing Tao News , 9 GAG co-founder Chan Chin Cheng acquired 53.83% of the shares of Home Office Holdings for approximately HK$79.65 million (approximately US$10.2 million) through his holding company Home Office Development Limited. After completion, his shareholding increased to 70.11%.

(Data source: PR Newswire ; HKEX announcement )

The company was subsequently renamed Mi Strategy, claiming to build Asias first listed virtual asset ecosystem enterprise, integrating 9 GAGs social media resources, focusing on virtual asset investments such as Solana, and planning to allocate Bitcoin.

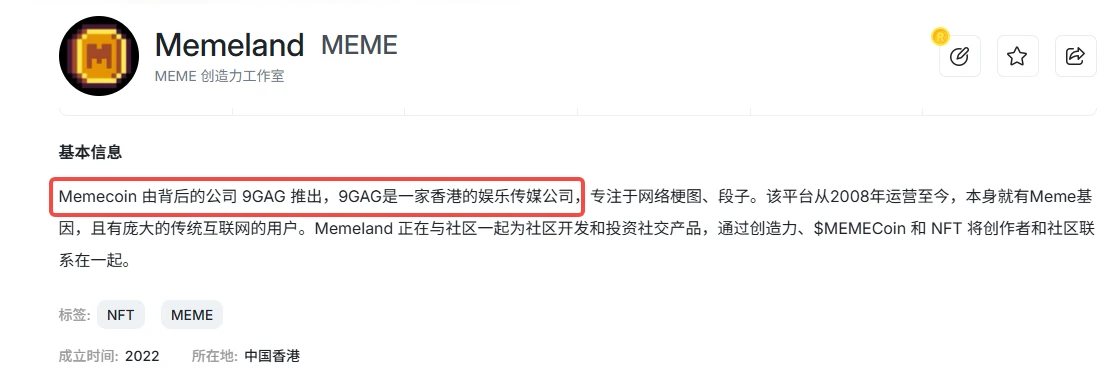

You may not know 9 GAG, but you have probably heard of the Memeland project and the corresponding MEME token.

9 GAG, the parent company behind Memeland, was founded in 2008 and is headquartered in Hong Kong. It attracts young users with humorous memes and jokes.

9 GAG Lianchuangs acquisition and name change of Haoliang Technology Holdings was also accompanied by changes in the original companys equity and board structure.

Before the acquisition, Haoliang Technology Holdings Limited held 53.83% of the shares, and the board of directors consisted of 7 people from the original company; after the acquisition, the original team of 9 GAG and people in the Hong Kong crypto community became key figures in Mi Strategy:

Former 9 GAG co-founder Chen Zhancheng will serve as chairman of the board and CEO, fully leading the companys strategic development and business operations. His younger brother Chen Zhanjun will serve as the chief brand officer of Mi Strategy. He was also previously the chief product officer of 9 GAG.

The former Chief Business Officer of 9 GAG will also take up the same position at Mi Strategy, while Li Minghong, former CEO of OSL and former head of strategic planning and institutional relations at HashKey Group, will serve as Chief Investment Officer. It is worth mentioning that the 2,440 Solana purchased by Mi Strategy were also completed with the assistance of OSL. In addition, Peng Cheng, co-founder of Scroll, will also serve as an independent non-executive director of the company.

The concentration of equity and the replacement of the board of directors signify the 9 GAG team鈥檚 full control over the Mi Strategy.

Haoliang Technology was originally an Internet of Things technology company that provides data transmission and processing services, covering Internet of Things antennas, 5G equipment and maintenance, serving the manufacturing, transportation, energy and other industries. Its market value is about HK$500 million, and it is called a low-market-cap centi-stock by Hong Kong media;

Its technology-related business attributes and low market capitalization make it an ideal target for 9 GAG鈥檚 backdoor listing.

Currently on the official website of Mi Strategy, you can see that the company focuses on ABC business, namely AI, blockchain and culture, and calls itself the first listed digital asset company in Asia.

Recently, in the traditional capital market, it is not uncommon for people in the cryptocurrency circle to use the shells of small companies to reserve crypto assets. This wave of enthusiasm has finally come to Hong Kong stocks.

(Related reading: Buying coins, the new wealth code for US listed companies )

9 GAG and Memeland鈥檚 past in the cryptocurrency world

In 2022, 9 GAG launched Memeland, positioning itself as a Web3 startup studio.

In the previous hot versions of NFT and Meme, Memeland issued MEME tokens and NFT projects such as Captainz and Potatoz.

At present, the market value of MEME tokens is only about 80 million US dollars, which has shrunk by more than 80% from its peak in 2023; in comparison, the pure Meme coin LABUBU on the chain with the same name, which is recently themed after Pop Marts Labubu, has a market value of about 50 million US dollars.

Memelands NFT series Captainz and Potatoz are facing a more severe market environment.

Captainz鈥檚 current floor price is only 0.3 ETH, with only single-digit trading volumes in the past day. The transaction price is also far from the high price of 50 ETH during the peak period.

How glorious it was in the past, how deserted it is now.

In 2024, the cooling of the crypto market further hit Memeland鈥檚 business model. As the NFT craze faded and meme coin competition intensified, Memeland鈥檚 profitability fell sharply.

The failure in the cryptocurrency circle may be an important motivation for 9 GAG to switch to Hong Kong stocks and borrow the low-market-value shell resources of Haoliang Technology. SOL investment and Bitcoin plan continue Memelands encryption logic, and can also be seen as another trend of following the hot spots.

The story of MicroStrategy is a reflection of the recent craze of the cryptocurrency and stock markets in the Hong Kong market. In addition to the marketing enthusiasm, whether the Hong Kong version of MicroStrategy can be played well still needs to be tested by the market.

This article is sourced from the internet: Behind the surge in Hong Kong stock market fan strategy: Memelands parent company changed its name through a backdoor listing

Related: Listed on Binance Alpha, how much is your HAEDAL airdrop worth?

Original author: Alex Liu, Foresight News HAEADL is the token of Sui Ecosystem Liquidity Staking Protocol Haedal, which has been confirmed to be listed on Binance Alpha and Bybit spot. Haedal announced the completion of its seed round of financing in January, but the specific amount was not disclosed. Investors participating in this round of financing include Hashed, Comma 3 Ventures, OKX Ventures, Animoca Ventures, Sui Foundation, Flow Traders, Dewhales Capital, Cetus, Scallop, etc. In addition, Haedal has opened the airdrop query interface and will start token claims at 20:00 today (April 29). The author has accurately predicted the opening price of Sui Ecosystem WAL token in the article Is Sui Airdrop the Most Valuable? Comprehensive Prediction of WAL Token Value . This time, what is the reasonable price of…