MyStonks puts U.S. stocks on the blockchain. Can on-chain finance have its own Wall Street moment?

MyStonks, a decentralized US stock token trading platform, has completed a major upgrade and officially launched on-chain tokens covering 95 major US stocks. These include Microsoft (MSFT), Nvidia (NVDA), Apple (AAPL), Amazon (AMZN), Google (GOOGL), Meta (META), Tesla (TSLA), JPMorgan Chase (JPM), Bank of America (BAC), UnitedHealth (UNH) and other top global companies. This scale and depth of coverage are second to none in the field of on-chain assets, marking a new stage for on-chain US stock investment.

MyStonks has reached a strategic cooperation with Fidelity, a global asset management giant. Fidelity provides 100% asset custody guarantee for platform users to ensure that each token corresponds to real and compliant stock holdings. Users can directly buy and sell corresponding ERC-20 stock tokens through self-hosted wallets using USDT or USDC stablecoins. The platform converts stablecoins into US dollars, purchases real stocks, and mints tokens 1: 1 through the Base chain smart contract. The tokens held by users represent actual stock shares and can be traded or redeemed on the chain at any time. Price data is provided in real time by the Chainlink oracle to ensure that transaction prices are fair and transparent, greatly improving asset liquidity and security.

This innovation not only breaks down the geographical and process barriers of traditional brokerages, but also allows global investors to participate in U.S. stock investments with lower thresholds and higher transparency, ushering in an era of professional investment that is Wall Street-ized in on-chain finance.

U.S. stocks have performed well over the long term, offering both returns and security

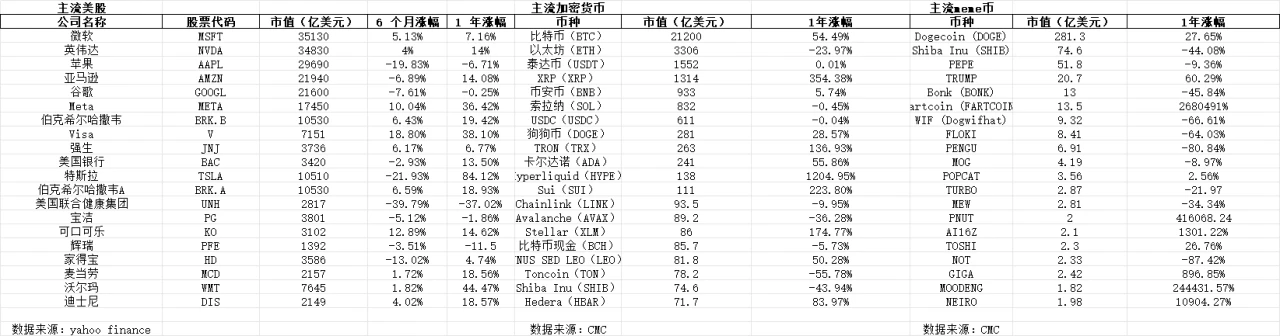

Throughout history, the U.S. stock market has long led the world in terms of yield and risk resistance. The combined market value of U.S. technology companies represented by the Big Seven (Microsoft, Nvidia, Apple, Amazon, Google, Meta, and Tesla) will reach $17.6 trillion in 2024. The overall market value has increased by more than 15 times between 2012 and 2024, with a compound annual growth rate of 26%. Even if there is a short-term adjustment in early 2025, these companies will still be the backbone of global innovation and value creation.

Behind the long-term steady growth of US stocks are the continuous innovation of the US economy, the mature regulatory system, the worlds largest capital market and the worlds reserve currency status of the US dollar, which provide investors with a higher safety margin and broader growth space. Microsoft, Nvidia, Apple, Amazon and other companies have shown steady growth in the past year and the past six months. Nvidias one-year growth is as high as 216%, and Microsoft has also increased by 14.7%. These companies not only continue to make breakthroughs in cutting-edge fields such as AI, cloud computing, and semiconductors, but also have strong cash flow and anti-cyclical capabilities.

In sharp contrast, the performance of mainstream coins and meme coins in the cripto market is extremely polarized. Bitcoin has increased by 54% in a year, and Ethereum by 36%, but mainstream coins such as SOL and TRX have even experienced negative growth. The meme coin sector has seen mixed gains and losses. PEPE has increased by more than 200% in a year, while TURBO, WIF and other coins have fallen sharply, even as high as -80% or more. The high volatility and high correlation of crypto assets make it difficult to effectively diversify investment portfolios. They chase hot spots in bull markets and their assets shrink significantly in bear markets. They lack a stable basic plate like US stocks.

Because of this, U.S. stocks have both growth and security in on-chain asset allocation, becoming the first choice for rational investors. Through the 95 U.S. stock tokens launched on MyStonks, investors can configure AI, cloud computing, finance, medical care, consumption and other diversified tracks on the chain in one stop, which can not only seize the global innovation dividend, but also effectively diversify risks. Compared with the traditional choice of either this or that, investors can now finally achieve diversified, professional and scientific asset management on the chain.

This means that investors no longer need to make an either-or choice between highly volatile crypto assets and traditional assets, but can achieve one-stop, diversified, and professional asset management on the chain. The long-term growth and risk resistance of U.S. stocks provide a solid base and safety cushion for investors on the chain.

Towards the “Wall Streetization” of on-chain finance, the era of professional investment has arrived

The tokenization of U.S. stocks promoted by MyStonks is not only a technological upgrade, but also a profound shift in the on-chain financial paradigm, opening a new chapter in the era of professional investment.

MyStonks allows on-chain users to build investment portfolios scientifically for the first time, just like institutional investors. The introduction of US stock tokens has brought on-chain investors professional and standardized asset allocation tools such as Beta allocation, Alpha mining, and relative value trading. Investors are no longer chasers of rising and falling of a single hot spot, but can build a stable and diversified investment portfolio based on fundamentals, industry logic and risk management. The on-chain financial market is gradually integrated with the global mainstream capital market, and the investment philosophy has shifted from emotional speculation to rational allocation.

MyStonks cooperates with Fidelity. All US stock tokens are 100% managed by real stocks. The entire on-chain transaction is executed by the Base smart contract. The price data is provided in real time by the Chainlink oracle. The process is open, transparent and traceable. Multiple security mechanisms such as multi-signature wallets, time locks, DID, etc. ensure the safety of user assets. Compared with centralized platforms and traditional brokerages, user funds are always managed independently, which greatly reduces the risks of misappropriation, freezing, black swans, etc., and greatly improves compliance and safety standards.

MyStonks breaks down traditional financial barriers such as region, identity, and threshold. Users do not need a bank account, only a digital wallet and stablecoins to directly participate in the worlds top asset allocation. This means unprecedented fair opportunities and wealth appreciation space for investors in developing countries and areas with insufficient financial services. For the first time, on-chain finance has truly achieved global inclusiveness, making professional asset allocation no longer a privilege for a few people.

MyStonks not only meets the professional investment needs of on-chain users, but also attracts the attention of traditional financial institutions, becoming an important bridge connecting traditional finance and the DeFi world. With the launch of more real-world assets (RWA) such as ETFs and bonds, the on-chain asset ecosystem will be richer and investors will have more diverse choices. The Wall Streetization of on-chain finance has brought about a paradigm shift in the industry, pushing global digital asset investment into a new stage of standardization, regularization, and specialization.

New heights of on-chain asset management, a new era of global investment

MyStonks on-chain US stock token trading platform, with its unique technical advantages and compliance guarantees, opens a new door to future finance for investors. It allows every investor to have their own Wall Street on the chain, realizing the free flow and scientific management of assets.

As the on-chain asset ecosystem continues to improve, MyStonks will continue to expand the on-chain asset categories to cover more industry leaders and real-world assets, and build a world-leading digital asset trading hub. It is not only a trading platform, but also a bridge connecting traditional finance and decentralized finance, helping investors to move forward steadily in the wave of digital economy.

In the era of professional investment, the Wall Streetization of on-chain finance has become a general trend. U.S. stocks, as the worlds most growing and secure asset class, are becoming the rational first choice for every investor in the digital age through MyStonks on-chain innovation. In the future, MyStonks will continue to lead global digital asset investment to a new level, so that professional, compliant, and secure asset allocation can truly benefit the world.

This article is sourced from the internet: MyStonks puts U.S. stocks on the blockchain. Can on-chain finance have its own Wall Street moment?

Related: Review of Binance airdrop craze: How CEX shapes the new generation of on-chain incentives

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) April is Binance鈥檚 airdrop month, and frequent wallet IPOs and direct airdrops have become a topic of discussion in the community. Binance Wallet has currently launched 15 exclusive TGE IPOs, 8 of which were launched intensively in April. At the same time, 7 direct airdrops were also held in April. In order to make the eligibility criteria for participating in TGE (Simbólico Generation Event) or receiving airdrops more quantitative, Binance launched the Alpha Points System on April 25. Why has Binances airdrops been so frequent since April? In fact, as early as April 14, He Yi posted a message clearly stating that Binance has no listing fee, but there are different types of listing airdrops. Projects that…