Who Defines “Facts”? The Truth of Power and the Space for Malice in Polymarket’s Resolution Mechanism

Author|Azuma (@ازوما_ايث)

Polymarket has once again found itself embroiled in controversy over fairness.

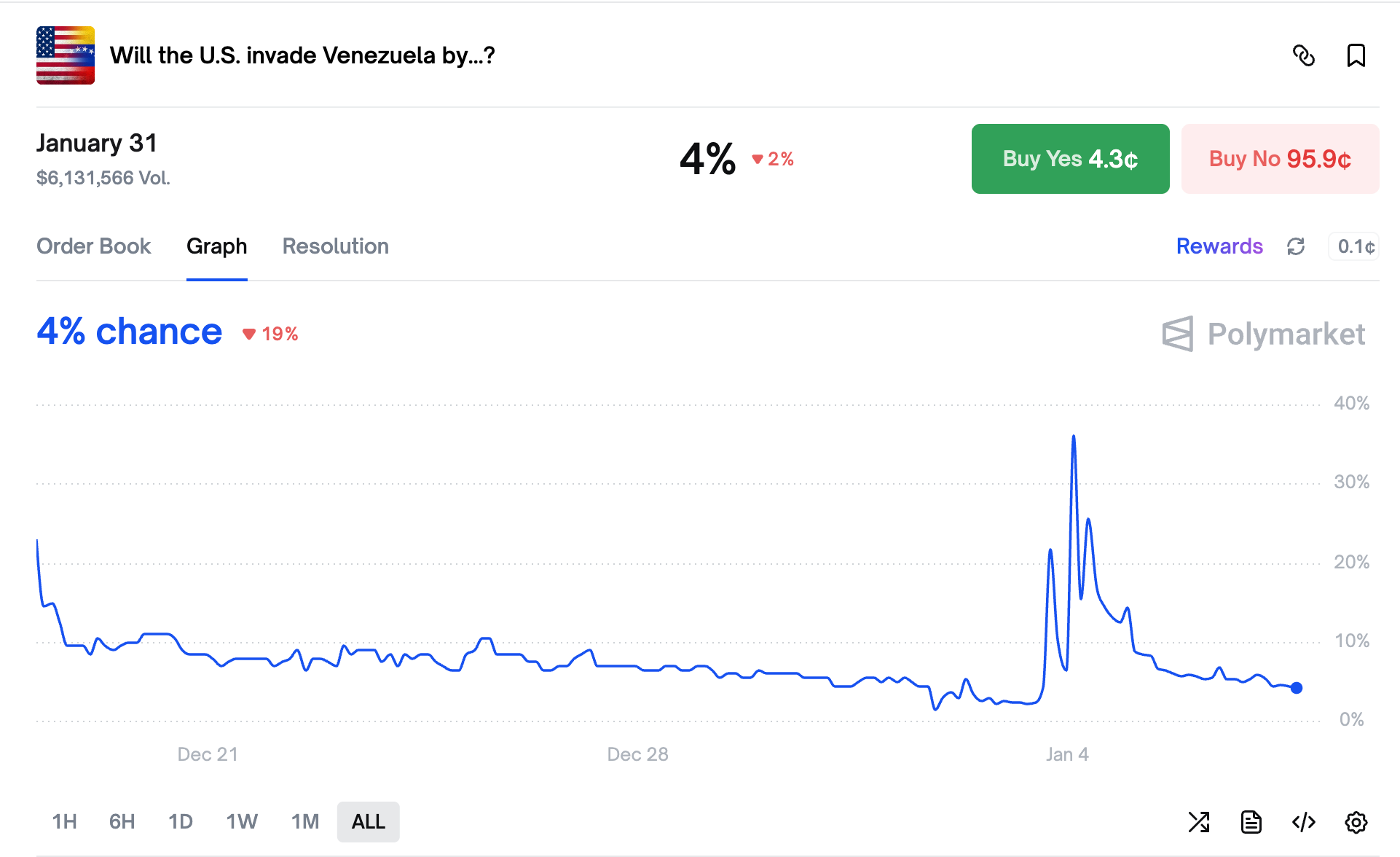

The incident stems from the “Will the U.S. invade Venezuela by…?” prediction market. On January 4, Polymarket intervened to clarify that “the previous U.S. operation to capture Venezuelan President Maduro does not meet the تحديnition of an invasion.” This statement caused the price of YES shares for the January 31st outcome (i.e., betting that the U.S. would invade Venezuela before January 31) to plummet, directly impacting the actual interests of many users.

- Odaily Note: The chart shows the price trend of YES shares for the January 31st outcome. The inflection point corresponds to the time when Polymarket officially intervened with the clarification.

This is not the first time Polymarket has faced similar controversy. Last year, we discussed analogous cases in two articles: “Polymarket Hit by Oracle Manipulation Attack: Can Whales Use Voting Power to ‘Reverse Black and White’?” and “Polymarket Faces Another Truth Dispute: What Zelenskyy Wears Will Determine the Fate of $140 Million“, where we briefly analyzed Polymarket’s result resolution logic.

In the discussion surrounding this latest event, we noticed that while many readers are aware that Polymarket relies on the oracle protocol UMA for resolutions, they are unclear about how this process actually works. Therefore, Odaily is publishing another article to dissect its resolution mechanism and explore the potential gray areas that could lead to result disputes.

Predefined Rules and Supplementary Explanations

أولاً، any prediction market on Polymarket is launched with a predefined set of rules. These rules clearly state the conditions for determining the outcome, the validity period, and anticipate how to judge under various unexpected circumstances.

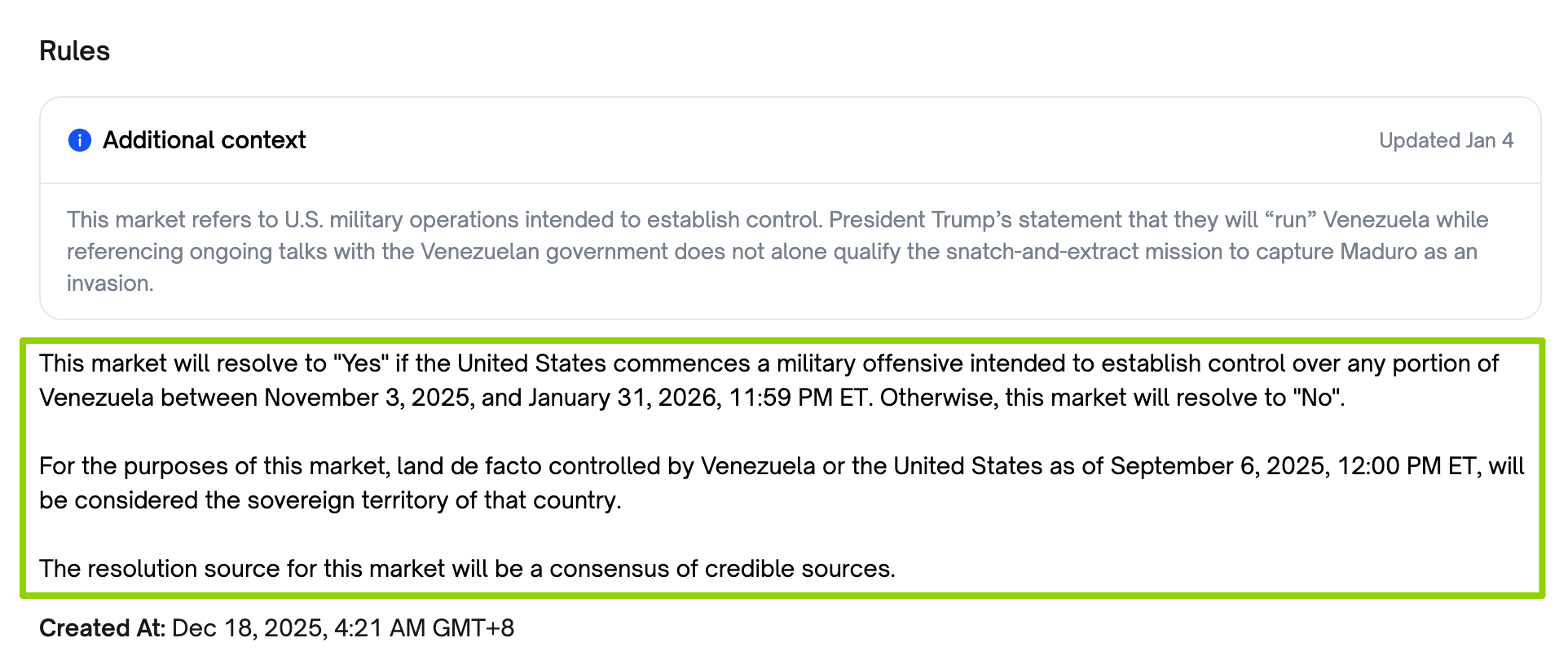

Taking the “Will the U.S. invade Venezuela by…?” market as an example. As shown above, the text under “Rules” constitutes the predefined rules for this market. The judgment conditions and validity period are: If the United States launches a military offensive aimed at controlling any part of Venezuelan territory between November 3, 2025, and January 31, 2026 (11:59 PM ET), the resolution is YES; otherwise, it is NO.

However, even with anticipation for various contingencies, sometimes events unfold in unexpected ways. In this case, no one could have predicted that a head of state could be so abruptly captured by another power. Therefore, in rare instances, Polymarket will personally intervene to provide supplementary explanations for unforeseen circumstances that were not anticipated when the market was created, offering further clarification of the rules. — The decision to clarify is not made unilaterally by Polymarket; users with doubts can proactively request clarification in the #market-review channel on Polymarket’s Discord.

Observant readers may have noticed that below the “Rules” section in the image above, there is a section with lighter font labeled “Additional context,” with a more recent update date (the predefined rules were posted on December 18 last year, while this content was added on January 4). This is precisely the supplementary explanation Polymarket provided in this instance. The specific content is: “This market concerns US military action intended to establish control. President Trump has stated he will ‘manage’ Venezuela in the context of ongoing negotiations with the Venezuelan government, but this statement alone is insufficient to characterize the ‘capture and extraction’ mission aimed at capturing Maduro as an invasion.”

In simple terms, Polymarket does not consider the U.S. capture of Maduro to be defined as an invasion of Venezuela and therefore does not support resolving the outcome as YES based on this event.

Let’s set aside the question of whether Polymarket’s supplementary explanation is reasonable. What’s more important to note here is that the validity period for this market (January 31) has not yet ended, meaning it has not entered the final resolution process. Emphasizing this point serves two purposes: first, to remind everyone that all current disputes essentially stem from rule ambiguity, unrelated to the resolution phase; second, to clarify that this controversy is not yet settled, and users’ current losses are actually unrealized losses. Everything depends on the final resolution.

So, how is the final resolution process executed?

The Resolution Process: Results Are Proposed by People

For any prediction market on Polymarket, the final resolution process requires someone to propose an outcome. Using the previous market as an example, the window for proposing a resolution is located under “Rules” at “Propose resolution.”

Of course, not everyone can casually propose random results. UMA and Polymarket have designed two layers of restrictions: economic incentives and a whitelist requirement.

The economic incentive means that proposing a result requires depositing a bond in USDC (typically 750 USDC, higher for some markets). After submission, there is a challenge window (typically 2 hours). If no one challenges during this period, the result is deemed valid and will be used as the basis for the final market resolution, which will not be changed. The proposer then receives a reward (typically 5 USDC). If challenged, it enters a dispute phase, where the proposer risks losing their bond (discussed in detail later). In essence, if someone proposes a result just to cause trouble, the risk far outweighs the potential reward.

- Odaily Note: Clicking on “Propose resolution” in the market reveals the bond requirement and reward amount for proposing a result.

The whitelist restriction refers to the fact that Polymarket initially allowed anyone to propose resolutions. However, to improve resolution efficiency, it introduced a whitelist maintained jointly with Risk Labs in August last year. Since then, only whitelisted addresses can propose results. There are three ways to join the whitelist: 1) Join the Risk Labs team, 2) Join the Polymarket team, or 3) Have submitted over 20 proposals with an accuracy rate exceeding 95% in the past three months. All addresses can be queried via this contract. Initially, there were only 40 addresses, but the number has significantly expanded since.

The Dispute Phase: A Game of Economic Interests

As mentioned in the previous section, if a proposed result receives no challenges during the challenge window, it is deemed valid. This is the final outcome for the vast majority of markets. However, in rare cases where a challenge is raised, how is the resolution determined?

First, it’s important to note that, similar to proposing a result, challenges cannot be raised frivolously — the challenger must post an equal bond in USDC (typically still 750 USDC) to confront the proposer. In other words, both parties must put equal stakes on the table. Unlike the proposer, the challenger does not need to provide a complete alternative result; they only need to point out a specific error in the proposer’s result.

Once a valid challenge is confirmed, the UMA community will debate the issue. This phase typically lasts 24-48 hours (voting occurs the next day, with at least 24 hours reserved for discussion). Anyone wishing to provide evidence for the discussion can do so in the #evidence-rationale and #voting-discussion channels on the UMA Discord server.

After the debate, UMA token holders will vote on the matter (this process takes approximately another 48 hours). Four possible outcomes can occur:

- Proposer Wins: The proposer retrieves their bond plus half of the challenger’s bond as a bounty. The challenger loses their bond.

- Challenger Wins: The challenger retrieves their bond plus half of the proposer’s bond as a bounty. The proposer loses their bond.

- Too Early: This outcome applies to proposals where the relevant event is not yet settled, such as an ongoing sports match result. The challenger receives a refund plus half of the proposer’s bond as a bounty. The proposer loses their bond.

- Split (50:50): The rarest case. In this scenario, the challenger retrieves their bond and receives half of the proposer’s bond as a bounty. The proposer loses their bond.

Two points are noteworthy regarding the above voting outcomes.

First, in three of the four potential scenarios, the challenger can profit, while the proposer profits in only one. This is an intentional design by UMA, using the imbalance of risk and reward between the two parties to incentivize higher accuracy in proposed results. Since a challenger only needs to point out one flaw to win, the proposer must provide a result that is as accurate and compliant with standards as possible.

The second point is that UMA’s governance voting power holds absolute authority over the final result. In other words, the multi-billion-dollar prediction market spectacle built by Polymarket is, at its core, supported by a protocol with a fully diluted valuation of only around $100 million.

Exploring the Gray Areas

Combining the analysis of Polymarket’s resolution process above with a review of historical real dispute cases, it’s not difficult to see that there are certain gray areas in both the rule-setting/supplementary explanation phase during market operation and the final resolution process that can lead to controversy.

First, regarding the rule-setting and supplementary explanation phase, the essence of its ambiguity lies both in the fact that written rules sometimes cannot cover real-world variables and in the fact that the same textual description can often be interpreted in different ways. For example, in last year’s “Did Zelenskyy Wear a Suit?” incident, the rules did not explicitly state whether “military-style suits count as suits.” While Polymarket clarified in its supplementary explanation that “reliable reporting has not confirmed whether Zelenskyy wore a suit,” it did not define what constitutes “reliable reporting.” Such ambiguities inevitably lead to disputes.

If Polymarket, as the platform operator, could maintain neutrality, it might not provoke public anger every time, but the situation is hardly ideal. Polymarket’s operating entity is based in the United States, which means the regulatory environment and political context it faces make it difficult to remain completely neutral on all geopolitical issues. For instance, in the current “Will the U.S. invade Venezuela?” matter, when it involves U.S. military or diplomatic actions itself, rule interpretations tend to lean towards more conservative, “non-militarized” language. This is understandable, but ultimately, it’s the users who suffer the losses.

As for the resolution process, the source of ambiguity points directly to the potential for manipulation in UMA voting. Although UMA designed a reward/punishment game mechanism to constrain proposal behavior and improve result accuracy, this mechanism only constrains economic interests within its system. When external profit opportunities exist, theoretical room for malicious action remains. This is not unfounded suspicion. In last year’s “Ukrainian Rare Earth” incident, a UMA whale manipulated voting power to forcibly reverse the outcome, resulting in $7 million worth of bets being settled incorrectly.

The existence of these gray areas is the root cause of frequent accusations that Polymarket is unfair and represents a structural issue prediction markets need to address. In fact, any prediction market involving complex real-world events inevitably faces a triple dilemma: First, real-world events themselves often cannot be clearly binarized; geopolitics, military actions, and diplomatic games are inherently full of gray areas. Second, rules must be expressed in language, but language naturally allows for interpretive space. Third, once a resolution mechanism introduces human or governance participation, it inevitably becomes subject to interest-based博弈.

From a user’s perspective, perhaps you need to realize early on — in prediction markets, what you are betting on is not “what will happen in the world,” but “how the rules will ultimately be interpreted.”

هذا المقال مصدره من الانترنت: Who Defines “Facts”? The Truth of Power and the Space for Malice in Polymarket’s Resolution Mechanism

Core Summary: • From a macro technical perspective (see Figure 3 below): On the Bitcoin daily chart, the upward trend line representing the long-term bull market (since the end of 2022) and the downward trend line defining the recent correction (since the October 2025 high) are about to converge. Currently, the market is in a corrective consolidation phase following the breakdown of the long-term trend. Bitcoin’s price is under double pressure. Until the price breaks through this double pressure with strong volume, all upward movements should be considered rebounds within a bearish pattern. The ultimate basis for judging the market’s medium-term direction will be whether these two key trend lines are effectively broken. • Core viewpoint validated: The core judgment made last week that “the market will most likely enter…