78 million repurchase + CCMs: How deep is Pump.fun’s Meme hegemony moat?

Original translation: Saoirse, Foresight News

You’ve probably all noticed that Pump.fun has recently regained its market dominance. In my previous article, I focused on analyzing competitors and the current state of trading terminals. In this article, I’ll focus on the bullish logic behind Pump.fun and the vast market opportunities emerging in CCMs (Creator Capital سوقs) through native Launchpad live streaming.

Today, the PUMP token price is comfortably above its ICO fundraising price, and the platform has rolled out numerous updates, indicating a positive outlook. Let’s delve deeper into the details.

PUMP’s revenue flywheel

Since the ICO, more than half of the participants have sold their tokens, and a large number of tokens have been transferred to other wallets – this is most likely to be sold in batches to different buyers through one or more KYC-verified wallets.

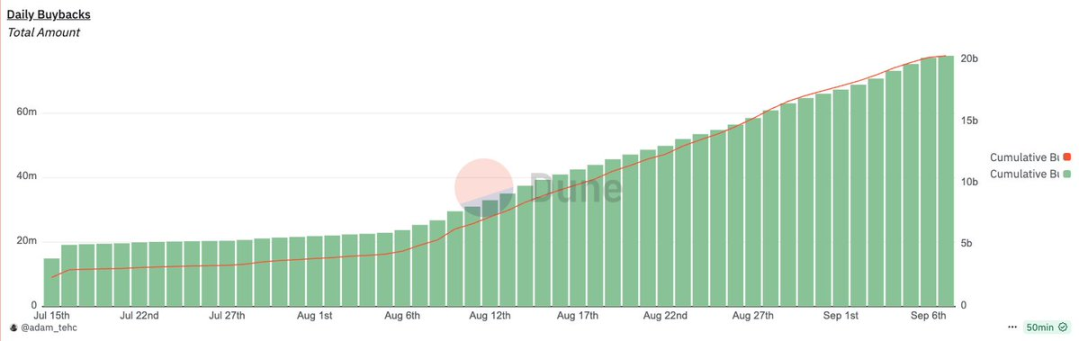

Following the token’s initial launch, the price of the token dipped. To address this, Pump.fun initiated a “revenue buyback” mechanism, with daily buybacks typically exceeding 90%-95% of the token’s total revenue. To date, the total buybacks have exceeded $78 million. The official Pump.fun buyback dashboard displays the daily buyback amount and the “supply offset percentage” (currently 5.75% of the circulating supply has been offset).

I previously suggested that the Pump.fun team add a “cumulative repurchase curve” to the dashboard to visually demonstrate the growth trend of repurchase scale. Until the official update is released, you can refer to the unofficial dashboard created by @Adam_Tehc.

As can be seen from the data, Pump.fun’s daily repurchase amount reaches 1 million to 2.5 million US dollars, and the scale is still growing rapidly – this forms a complete “revenue flywheel”: Pump.fun uses revenue to repurchase tokens → attract more users, drive transaction volume and fee growth → the platform obtains higher revenue, and then increases repurchase efforts to drive the flywheel to continue running.

Currently, the PUMP mainchain liquidity pool has a capital scale of approximately $20 million to $30 million. This repurchase capacity is sufficient to offset the selling pressure from existing holders. In addition, the liquidity pool is paired with USDC, which also enhances its resistance to SOL price fluctuations.

A comparison of price-to-earnings (P/E) ratios compiled by @jermywkh shows that Pump.fun is significantly undervalued compared to competitors with higher market capitalizations and lower revenue. If the market environment improves, PUMP could potentially reach valuation parity.

Competitive Landscape

The core difference between Pump.fun’s “flywheel effect” and recent competitors such as Bonk and Heaven Dex lies in the “native community” and “ecological culture” it has accumulated in the Solana Meme coin field.

These competitors lack both past performance and sufficient profit reserves. The Pump.fun team, with its established ecosystem and past achievements, has a significant first-mover advantage in future development.

Now, with the launch of the full-featured Pump.fun mobile app, the introduction of live streaming, and a significant increase in creator fees, Pump.fun has further solidified its position as the premier platform for issuing and trading meme coins — initiatives we’ll break down in detail below.

I personally believe that one of Pump.fun’s strengths is that it doesn’t force developers, traders, or ordinary users to follow a specific path, instead allowing the community to independently determine the product’s development direction and potential uses. However, Pump.fun still has room for improvement in providing developers with more comprehensive tools to facilitate building projects based on Pump.fun.

In terms of cash reserves, Pump.fun had achieved approximately US$800 million in revenue before the repurchase. Combined with the US$500 million raised during the PUMP ICO phase, the team currently still holds approximately US$1.3 billion in funds – a scale that no competitor can match.

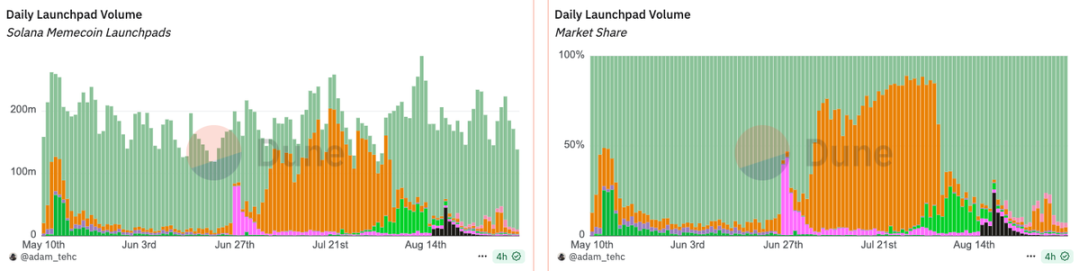

To briefly summarize the current market share: Pump.fun has regained its market dominance of over 80%-90%, Bonk’s leading advantage continues to weaken, Heaven Dex briefly rose but quickly faded, and Believe poses almost no competitive threat.

Analysis of key projects

Ascend: A new solution to increase creators’ income tenfold

The biggest pain point of the Meme coin launch is the difficulty maintaining the ecosystem after the hype fades. The core goal of the Ascend project is to provide sustained motivation for creators by increasing transaction fees tenfold—giving them a stable source of income they can invest in long-term token promotion.

Issuing tokens on Pump.fun is completely free, and during the “pre-binding phase” (token market value of $0-85,000, calculated based on the SOL price of approximately $200), creators can receive a 0.3% commission share of transaction volume.

In terms of charging rules: Pump.fun charges a handling fee of 0.93% (close to 1%) in the pre-binding stage, and a fixed handling fee of 0.05% after binding. In addition, an additional 0.2% liquidity pool (LP) exchange fee is required.

Creator fees will be adjusted dynamically as the token market value grows: when the market value is between $10 million and $11 million, the fee range is 0.3%-0.9%; when the market value approaches $20 million, the fee will gradually drop to 0.05% (still calculated based on SOL of approximately $200).

This mechanism has brought about a significant change: during a token’s low market capitalization phase (below $10 million), transaction fees are significantly skewed toward creators, allowing many creators of newly issued tokens to reap extremely high returns. Previously, a token’s prolonged low market capitalization would be considered a bearish signal; now, it can actually become a bullish signal—because creators have a stronger incentive to maintain the token ecosystem.

In theory, when a token’s market capitalization reaches a high level, large traders no longer need to worry about high fees (and can safely increase their trading volume); however, this hasn’t been demonstrated for many high-market-cap tokens yet. Notably, tokens issued before the Ascend project’s launch will now also receive a higher share of transaction fees—a significant positive for the existing token ecosystem.

For reference, the chart below shows the recent changes in creator fees for popular tokens before and after the Ascend project.

Glass-Full Foundation

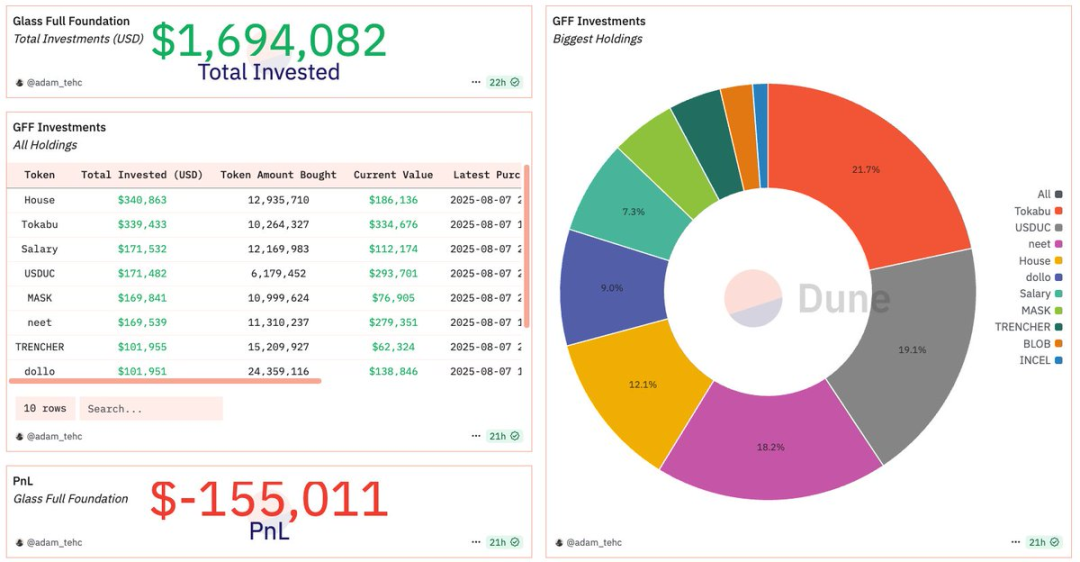

Earlier, the Pump.fun team launched the “Glass-Full Foundation”, planning to use part of the revenue to repurchase popular tokens on the platform and include these tokens in the platform’s balance sheet.

While this initiative was well-intentioned, it was essentially just a “small amount of support for the ecosystem,” more like a short-term strategy to counter a similar competing initiative launched by Bonk at the time. This is reinforced by the Foundation’s lack of new buybacks over the past month. Nevertheless, the community’s response to the Foundation remains positive.

To date, the foundation has repurchased $1.6 million worth of Pump.fun’s popular tokens, with an overall loss of only 10%; and these tokens are unlikely to be sold, which is equivalent to a disguised “destruction” (reducing the circulating supply).

The tokens that have been repurchased include: TOKABU, USDUC, NEET, DOLLO, and INCEL.

Live streaming and CCMs (Creator Capital Market)

Pump.fun recently released growth data for its live streaming service. New live streaming platforms often struggle to quickly gain user acceptance, but Pump.fun’s performance is very impressive, and the data is enough to prove its appeal.

The optimization of creator fees not only greatly incentivizes “live streaming of popular events”, but also attracts “non-تشفير anchors” to try this new way of traffic monetization: on traditional live streaming platforms, anchors not only face fierce competition, but also need to meet thresholds such as “minimum number of fans” and “minimum number of viewers” before they can monetize, and there is no guarantee of high returns after monetization.

On Pump.fun, streamers can stand out more easily – they can quickly attract attention through “token-related interactions”, achieve traffic explosions through popular events, and then obtain high returns through creator fees and initial token supply (if they choose to sell for profit).

I believe that the entry of micro-influencers into Pump.fun live streaming is just getting started: on the one hand, issuing tokens on Pump.fun is completely free; on the other hand, live streaming can be conveniently started through mobile applications – this low-threshold model will continue to grow the demand for this scenario.

I personally plan to start live streaming on Pump.fun in the near future. After team research, we hope that Pump.fun can provide more support for anchors: such as more complete development tools (to facilitate building functions based on the platform), more detailed data analysis functions, and more live streaming features.

Mobile-first strategy: Spotlight on top traders and developers

Pump.fun has always clearly emphasized “mobile first” and has integrated rich social features into the native application: including KOL/top trader rankings, token-specific chat rooms (only visible on the app), live broadcast real-time chat, and even private messaging between users.

It is not difficult to foresee that as user penetration increases, these social functions will continue to be optimized, further strengthening the positioning of “Pump.fun is the preferred platform for Meme coin trading and issuance.”

It’s important to note that developers are the core of the عملة الميم ecosystem—without them, there would be no new tokens. In the future, Pump.fun is likely to increase its support for developers, for example by prioritizing the promotion of high-quality creators and providing them with exclusive showcase platforms similar to “KOLSCAN.”

Currently, websites such as https://devscan.wtf and https://www.devscan.tech have made initial attempts to display the “top high-frequency issuers” and their related data.

Summary and Outlook

Pump.fun has a bright future ahead of it: with a vibrant community and a clear token economics model, Pump.fun has undoubtedly regained the community’s trust through ecosystem-aligned protocol design and transparent communication.

Even though PUMP tokens won’t unlock until July 2026, there is still huge room for future growth.

هذا المقال مصدره من الانترنت: 78 million repurchase + CCMs: How deep is Pump.fun’s Meme hegemony moat?Recommended Articles

ETHGlobal New York provided a platform for developers to experiment with Web 3 technologies. Participants were able to develop innovative projects, learn new technologies, expand their professional networks, and connect with their peers. During the event, developers leveraged various blockchain protocols and tools to build projects covering multiple use cases. Odaily participated in ETHGlobal New York and will introduce the winning projects below. Rivals: Augmented Reality Shooter Rivals is a multiplayer shooter that combines AR technology with a blockchain economy. Players use their phones to battle AI-controlled zombies in a real-world environment. Killing zombies rewards players with RIVAL tokens, while death deducts a portion of their token balance. The game uses Unity AR Foundation for environmental awareness, allowing virtual zombies to navigate and interact in the player’s physical space. The…