Gate Research Institute: Turtle Trading Rules, classic trading system reproduced, annualized up to 62.71%Recommended Art

- The Turtle Trading System is a classic trading strategy based on trend breakouts and mean fluctuations. It uses the Donchian channel to determine entry and exit signals, combined with the ATR indicator for stop-loss and position management, to achieve systematic trend following.

- The Improved Turtle Trading System introduces a sliding ATR stop-loss and exclusion range mechanism based on the traditional Turtle Trading System, dynamically adjusting the stop-loss bandwidth and the timing of adding positions, enhancing the robustness and profitability of the strategy in the high volatility and frequent shock environment of the تشفير market.

- Backtesting results show that the improved strategy outperforms the original Turtle strategy on hourly GT/USDT data, as evidenced by a higher Sharpe ratio, lower maximum drawdown, and more robust annualized returns. In particular, the high-frequency version demonstrates significantly improved trend sensitivity and risk control capabilities.

- In the future, we can further optimize strategy performance, enhance profit potential and risk management level by introducing leverage, expanding more parameter combinations and combining on-chain data and AI-assisted signals.

1 المقدمة

In traditional financial markets, the Turtle Trading Strategy is widely popular for its clear entry and exit rules, risk control measures, and trend identification capabilities. It achieved an annualized return of 24% in the commodity futures market from 1990 to 2000, and 12% in the Hang Seng Index futures market from 2005 to 2015.

With the rise of the cryptocurrency market, this emerging asset class, owing to its high volatility and strong trending nature, has become a new battleground for technical trading strategies. However, the cryptocurrency market presents numerous structural differences from traditional markets: 24/7 trading hours, generally higher volatility, stronger sentiment drivers, and shallower market depth, all of which present significant challenges in migrating existing strategies.

Do the Turtle Trading Principles still work in the highly volatile cryptocurrency market?

In recent years, academia and industry have gradually explored the application of traditional trend-based strategies to crypto assets, such as the improved Turtle Trading System (AdTurtle) proposed by AdTurtle (2020). This report will reconstruct this system and apply it to the GT/USDT trading pair, conducting a systematic backtest evaluation using historical data from 2022 to 2025. Key research topics include:

•Verify the applicability of traditional Turtle strategies in crypto trading;

• Explore the practical effects of introducing the sliding ATR stop-loss and exclusion range mechanism into the improved Turtle Trading System;

•Based on AdTurtle, propose optimization directions to adapt to the encryption market structure.

2. Traditional Turtle Trading System

The traditional Turtle Trading System is a classic trend-following strategy. Its core logic is to “buy and hold when prices break past highs; increase positions when the trend persists; and exit positions when the trend reverses.” Its implementation involves the following concepts:

•Donchian channel: Use the highest and lowest prices of the past N days to construct upper and lower bands to determine breakthrough signals.

•ATR (Average True Range): A measure of market volatility, widely used to calculate stop-loss levels.

2.1 Entry Signal: Price Breakout

•If the current price breaks through the highest point of the past N days, which is the upper track of the Donchian channel, establish a long position.

•If it falls below the lowest point of the past N days, i.e. the lower track, establish a short position.

•Donchian channel period N represents the observation window used to calculate the “historical high/low points”, reflecting the length of the market trend.

• Common settings:

○Fast system: entry period N = 20, exit period M = 10.

○Slow system: entry period N = 55, exit period M = 20.

2.2 Stop-loss setting: based on ATR

• Set a stop loss level when opening a position: opening price ± 2 × ATR.

•ATR (Average True Range) measures market volatility.

•ATR period n represents the number of days to calculate the average volatility and is usually set to 14.

2.3 Increasing Position Mechanism: Increasing Positions Following the Trend

• Gradually increase your position in the direction of the trend every time the price rises by 0.5 × ATR (for long positions) or falls by 0.5 × ATR (for short positions);

•The risk of each increase in position is controlled at 1-2% of the account, and a maximum of 4 increases are made. Positions are built in batches to maximize profits.

2.4 Exit Signal: Reverse Breakout

If the price breaks below (or rises above) a shorter-term Donchian channel, it could signal the end of the trend.

•Lift positions immediately to lock in profits or avoid drawdowns;

•The exit period is usually shorter than the entry period, such as 10 days or 20 days.

2.5 Fund Management and Risk Control

•The maximum loss on a single transaction shall not exceed 2% of the account balance;

• Position sizing is dynamically adjusted based on market volatility (ATR). The greater the volatility, the smaller the position.

•Accurately calculate the position size before each transaction, and prioritize risk control over market predictions.

3. Improved Turtle Trading System

AdTurtle is an optimized version of the classic Turtle trading strategy, maintaining its core concept of trend breakouts while introducing greater robustness in stop-loss logic and position entry mechanisms. It incorporates the ATR (Average True Range) indicator as an exclusion zone to prevent immediate re-entry after a stop-loss, thereby improving strategy stability and performance. Named AdTurtle (Advanced Turtle), this system is the first to incorporate a sliding and variable ATR stop-loss strategy with an exclusion zone into a Turtle trading system. Its core objectives are:

•Avoid opening positions again immediately after frequent stop-loss orders;

• Improve stability in highly volatile market conditions;

•Suitable for high-frequency trading or automated strategies.

The concepts involved are:

•Sliding Stop Loss: As the price moves in a favorable direction, the stop loss line moves up/down accordingly, locking in part of the profit.

•Variable Stop Loss: The stop loss bandwidth is dynamically adjusted with the current ATR to adapt to market fluctuations.

•Exclusion Zone: Set a buffer zone after the stop loss. Reopening the position is allowed only when the price breaks through this zone to avoid repeated stop losses during frequent fluctuations.

The following figure shows the AdTurtle infrastructure:

3.1 Entry Signal: Price Breakout + Exclusion Zone Filter

• Identify the trend starting point also based on the Donchian channel;

•Introducing the “Exclusion Zone”:

○When the previous transaction is exited due to stop loss, the system will not open a new position immediately;

○It is necessary to wait for the price to move away from the previous stop loss price ± Y × ATR before reopening the position;

○Effectively avoid repeated entry and exit during violent fluctuations.

•Donchian channel periods are divided into:

○Standard period: x (opening position) and x/n (closing position);

○Expansion cycle: y (re-entry) and y/m (re-closing), used to filter high-frequency repeated entries and exits.

3.2 Stop-loss mechanism: sliding + variable ATR range

Compared to the traditional fixed 2 × ATR stop loss, AdTurtle uses a combination mechanism to achieve smarter risk control. Sliding stop loss + variable interval width

• (When opening a position): Initial stop-loss setting

○Long position opening:

○Short position opening:

• (When the price moves in a favorable direction): Slide update logic

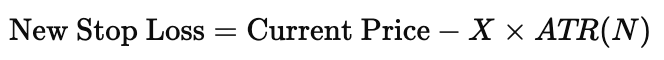

The long stop loss position is updated to:

The short stop loss position is updated to:

The short stop loss position is updated to:

• (ATR real-time update): variable interval mechanism

•Update ATR value for each K-line:

• Stop-loss automatically widens when volatility rises and tightens when volatility falls, helping to adapt to market conditions.

This mechanism can:

• Lock in trend profits;

•Avoid short-term price noise;

•Improve the rationality and timeliness of stop-loss execution.

3.3 Increasing positions with the trend: Increasing positions as the trend continues

• Automatically increase the position every time the price moves in a favorable direction by Z × ATR (Z is a custom multiplier parameter; used to set the sensitivity of the “increase trigger threshold”);

• Each time you increase your position, the risk is 4% of your account funds, with a maximum of 4 increases, and the total risk limit is 20%;

•The logic of increasing positions is consistent with the classic Turtle Trading method, and the pyramid-style entry method is still used.

3.4 Risk Management: Dynamic Calculation + Position Control

• Position size is calculated based on the current ATR value of the market, with larger volatility leading to smaller positions;

•Introducing smarter trigger mechanisms (exclusion zones, dynamic stop-loss) to improve actual execution results;

3.5 Comparison of Two Turtle Trading Systems

In the 1980s, the Turtle Trading System (Turtle Trading System) became a legend among trend-following strategies thanks to its simple rules and astonishing returns. Its core principles: identifying price breakout signals through Donchian channels, setting a fixed multiple of the Average Trend Reduction (ATR) to control risk, and employing a pyramiding strategy to follow the trend. However, with the evolution of market structure, especially in today’s era of high-frequency trading and frequent false breakouts, the classic Turtle strategy has exposed some obvious shortcomings.

The most common problem is that during false breakouts and volatile market conditions, strategies are prone to re-entering the market immediately after a stop-loss, magnifying consecutive losses. Traditional fixed stop-loss widths (such as 2 × ATR) also lack the adaptability to current market volatility. They can cause stop-losses to occur too early during large fluctuations or lead to excessive risk exposure when volatility subsides. Furthermore, because the system lacks a built-in “buffer period” for market fluctuations, mechanical entry and exit can occur after extreme sentiment or unexpected events, leading to increased drawdowns and reduced strategy stability.

AdTurtle retains the fundamental structure of the Turtle strategy: “breakout + add to position + risk control,” but introduces three key optimizations: an exclusion range, a variable stop-loss mechanism, and dynamic entry control. The exclusion range is a core innovation of the entire system. When a trade is exited due to a stop-loss, the system does not immediately allow reopening. Instead, it requires the price to break through the stop-loss price ± Y × ATR before re-entering the position. This mechanism significantly reduces the risk of a “stop-loss, re-entry, and re-stop-loss” cycle in volatile markets.

AdTurtle employs a sliding and variable-width stop-loss mechanism. When prices move in a favorable direction, the stop-loss level “slides” to lock in profits. The width of the stop-loss band adjusts in real time based on the ATR, automatically widening during high market volatility and tightening during low volatility. This dynamic mechanism better reflects actual market conditions and effectively prevents traders from being knocked out by short-term noise.

When the trend continues, AdTurtle retains the classic strategy of “adding to a position every Z × ATR,” emphasizing gradually increasing positions based on profitability rather than taking a single, risky bet. The number of position additions and total risk caps are also strictly set to further strengthen risk control. Regarding position management, the system dynamically adjusts the size of the position based on the current market ATR level. The greater the volatility, the smaller the position, ensuring that risk remains within a manageable range.

The AdTurtle strategy emphasizes robustness and adaptability in complex market conditions. It’s not a simple replacement for classic strategies, but rather offers a more reasonable alternative in diverse market scenarios. In markets with clear trends and steady rhythms (such as some commodity futures and large indices), the classic Turtle strategy remains highly effective. In cryptocurrencies, forex, or any other highly volatile and volatile market, AdTurtle offers a trading strategy with lower drawdowns and higher win rates through its range exclusion and dynamic stop-loss mechanism.

4. Trading system backtesting

To evaluate the performance of these two strategies, this article uses the GT/USDT trading pair on the Gate تبادل as the research target. The backtest period is set from 2024 to 2025, with a data granularity of one hour. The initial capital is 1 million USDT, with no leverage, and transaction fees (0.1% on both sides) and slippage (0.05%) are included.

4.1 Data Source and Preprocessing

•Underlying assets: GT/USDT

•Data source: Gate API (Kline data)

• Time period: January 1, 2024 to January 1, 2025

• Time granularity: 1 hour K-line

•Data processing: unified format

4.2 Trading and Backtesting Assumptions

• Initial capital: 1,000,000 USDT

• Leverage: No leverage is used

•Transaction costs: 0.1% bilateral handling fee + 0.05% slippage for each opening and closing of a position

• Position limit: The maximum position of a single product shall not exceed 30% of the account equity

•Signal execution: After the K-line closing is confirmed, it will be executed at the opening price of the next K-line.

4.3 Strategy Parameter Optimization

We condense the core parameter combination of each strategy into a five-tuple (X/Y/N/M/P), which represents:

•X: Entry period (Donchian channel)

•Y: Exit period (Donchian channel)

•N: ATR calculation period

•M: Initial stop loss multiple (× ATR)

•P: Exclusion interval multiple (× ATR)

Strategy parameters are selected through grid search optimization to find the optimal parameter combination.

4.4 Strategy Backtesting Results

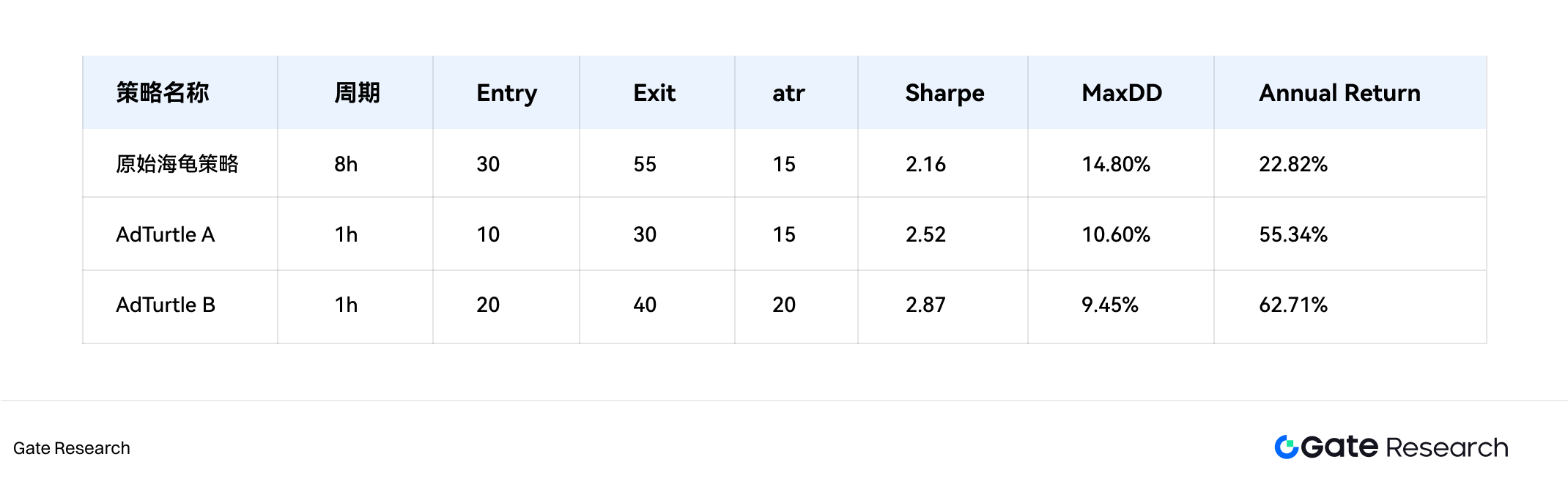

The following figure shows the backtest results of the optimal parameter combination of the three strategies:

Traditional Turtle strategies perform well in clear trending markets, but suffer significant drawdowns during periods of volatility or rapid reversals. The AdTurtle strategy, with its exclusion zone and dynamic stop-loss mechanism, effectively avoids many false signals, outperforming traditional versions in terms of overall return, Sharpe ratio, and maximum drawdown. The AdTurtle strategy is most stable in the short-term. After grid search optimization, the best-performing strategy portfolio achieved an annualized return of 62.71% with a maximum drawdown of less than 15%.

ختاماً

The Turtle Trading System, a classic trend trading model, holds an irreplaceable position for its clear structure and rigorous logic. Through its systematic trend identification and risk management framework, it remains highly applicable in the crypto market. However, the volatility, trading mechanisms, and investor structure of crypto assets differ from those of traditional markets, necessitating adaptation and optimization of the original strategy during migration. The AdTurtle strategy significantly enhances its viability and return stability in high-frequency, volatile market conditions by incorporating mechanisms such as exclusion zones, dynamic stop-loss orders, and variable entry thresholds.

Next, investors can expand their returns by testing more parameter combinations and introducing leverage. We recommend exploring the integration of on-chain data (such as fund flows and position changes), macro sentiment indicators (such as the Fear and Greed Index), and machine learning models to further enhance signal recognition and trade execution, thereby driving the intelligent evolution of trend trading strategies in the crypto market towards a higher level.

مراجع

•Github, https://github.com/odonnell 31/Turtle-Trading-Simulator

•Risk and Financial Management, https://www.mdpi.com/1911-8074/12/2/96

Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot spot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

تنصل

Investing in the cryptocurrency market carries a high level of risk. Users are advised to conduct independent research and fully understand the nature of the assets and products being purchased before making any investment decisions. Gate is not responsible for any losses or damages arising from such investment decisions.

هذا المقال مصدره من الانترنت: Gate Research Institute: Turtle Trading Rules, classic trading system reproduced, annualized up to 62.71%Recommended Articles

Host: Sam, Rosa Guest: Anatoly Yakovenko, Founder of Solana Source: Crypto Isnt for Everyone (And Thats a Good Thing) with Anatoly Yakovenko Podcast date: July 12, 2025 Compiled and edited by Lenaxin and ChainCatcher summary: This article is compiled from an in-depth conversation with Solana founder Anatoly Yakovenko on the More or Less podcast. He analyzed the industry cycle of punk, hoodies, and suits, pointed out that AI is just a product and crypto is a movement, and revealed how stablecoins quietly promote the globalization of the US dollar. At the same time, he explained the mission of Solana Mobile to challenge the monopoly of app stores and proposed that the future of the crypto industry does not lie in popularization, but should focus on serving high-net-worth niche groups. Wonderful…

Nive project