Huobi HTX Releases 2026 Opening Report: Trading Scale Grows Steadily, Building the Cornerstone for the Next Round of Growth with Long-termism

Amidst the combined influence of global macroeconomic uncertainty and kripto technology cycles, the cryptocurrency market in 2025 underwent a profound transformation, shifting from sentiment-driven movements to structural reshaping. The market gradually moved away from short-term speculative logic, turning towards a renewed focus on security, liquidity, and long-term value. The core competitiveness of leading trading platforms has also shifted from short-term traffic to security, liquidity, and long-term service capabilities. Recently, HTX (formerly Huobi) officially released its “2026 Opening Report,” providing a systematic review of its 2025 business performance, ecosystem development, and future strategy.

To read the full report, please visit: https://square.htx.com/zh/htx-2025-recap-2026-outlook-defining-the-next-growth-cycle-through-long-termism/

The report shows that HTX achieved steady growth in key metrics such as user base, trading volume, and compliance progress in 2025. By year-end, the platform’s global cumulative registered users surpassed 55 million, with 6 million new users added throughout the year. The annual cumulative trading volume reached approximately $3.3 trillion, a year-on-year increase of 39%, with net deposits of $608 million. The platform maintained a record of zero security incidents for the entire year and was selected for Forbes’ “2025 World’s Most Trusted Cryptocurrency Menukarkans” list.

Spot Trading Shows Steady Growth, Intelligent Alats Become New Engine

In volatile market conditions, HTX’s spot business demonstrated stable growth. In 2025, the platform’s cumulative spot trading volume exceeded $1.9 trillion USDT, a nearly 30% year-on-year increase.

The report points out that intelligent trading tools are reshaping user trading methods. The annual trading volume of spot trading bots grew by 97% year-on-year, with the scale of capital deposits doubling. Among them, stablecoin-related grid trading volume increased by 352% year-on-year, and mainstream coin grid trading volume grew by 122% year-on-year. By reducing operational frequency through automated strategies, spot trading bots have gradually become an important tool for users to navigate volatile markets.

New Asset Strategy Shifts to “First-Launch Value,” Strengthening Forward-Looking Layout Capability

Regarding new asset listings, HTX listed 166 new tokens in 2025. The overall strategy has shifted from chasing short-term sentiment to making preemptive judgments on the source of narratives and the lifecycle of assets.

The report shows that the platform achieved a first-launch effect multiple times in sectors such as Meme, AI, and crypto financial infrastructure. Assets including TRUMP, PIPPIN, and M saw gains of tens of times after their first launch on HTX. Simultaneously, within the stablecoin and compliant finance narratives, HTX was among the first to list assets like USD1, WLFI, and U, continuously strengthening its first-mover advantage in cutting-edge sectors. Through stricter screening mechanisms and a consistent listing pace, HTX is gradually building a differentiated advantage as a “First-Launch Value Platform.”

Contract Trading Scale Continues to Expand, Product and Liquidity Optimized Simultaneously

In derivatives, HTX’s annual cumulative contract trading volume reached $1.4 trillion, a year-on-year increase of approximately 50%, with trading volume showing a month-on-month growth trend. By introducing multiple top-tier market makers and optimizing trading structures, the depth and stability of core contract pairs like BTC and ETH have been continuously improved. Over 120 contract function optimizations were completed throughout the year, covering high-frequency usage scenarios such as order logic, funding rate display, and risk control mechanisms.

At the product level, the Contract Grid was upgraded to version 2.0, with monthly active users surpassing 30,000. The Copy Trading system was upgraded to version 4.0, introducing smart copy trading and fund segregation mechanisms, further lowering the barrier to entry for contract trading. Additionally, the Unified Margin mode supports multi-asset synergy, with related trading volume accounting for over 60% of total contract volume, significantly improving capital efficiency.

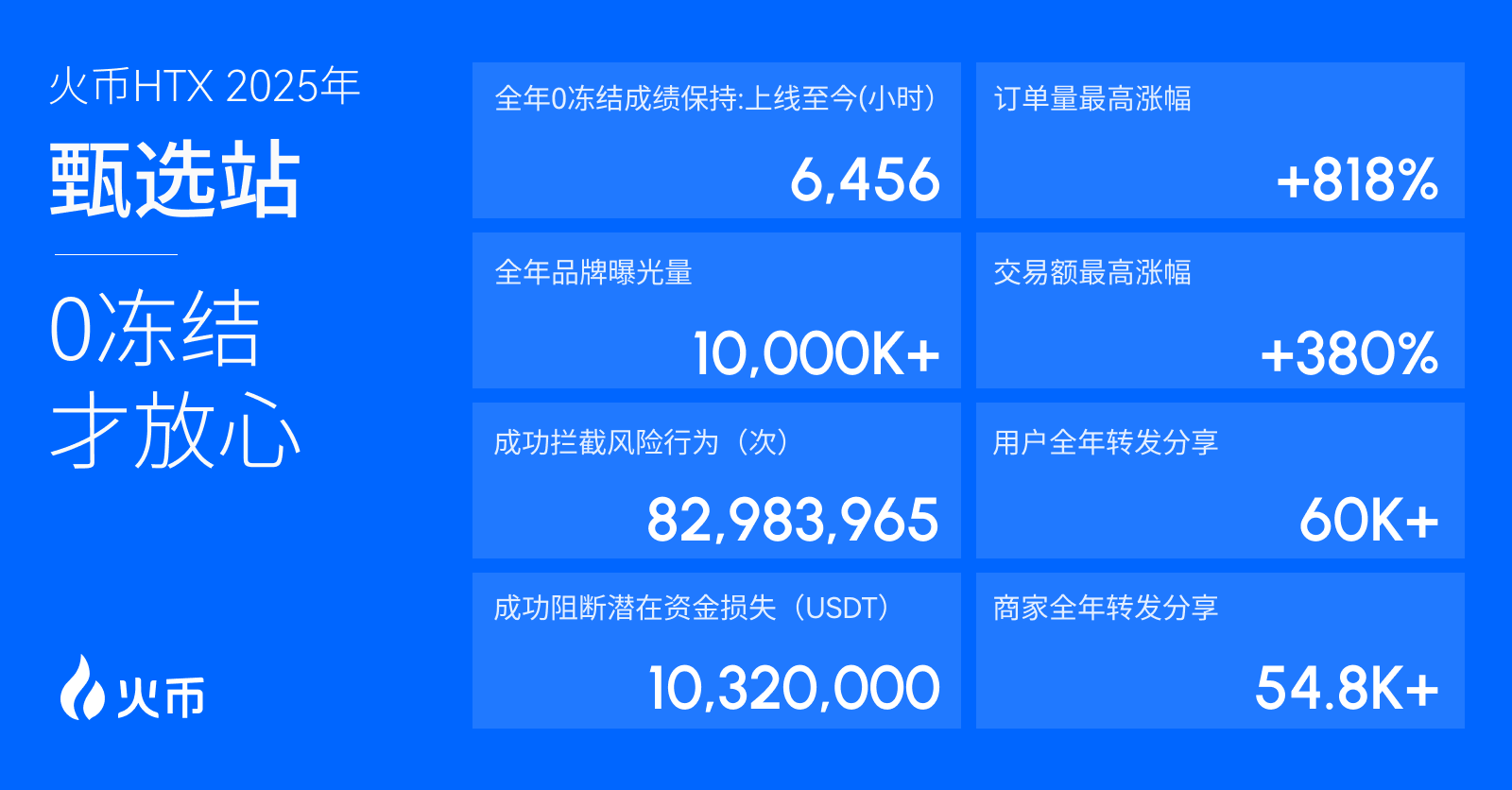

Pioneering C2C Select Zone, Leading OTC Service Upgrade

HTX’s over-the-counter (OTC) trading business continued to expand in 2025, consistently playing its role as a platform-level financial infrastructure. Throughout the year, OTC trading cumulatively served 3.93 million users, facilitating a trading volume of approximately $360 billion. It supports 74 fiat currencies and over 600 payment methods, covering 231 countries and regions.

Among these, the C2C Select Zone stands out as one of the most iconic innovations of the year, leading the industry’s OTC service upgrade. This dedicated zone, through a strict merchant准入机制, a full-process risk control system, and a “100% Full Compensation” guarantee mechanism, has maintained a record of zero frozen accounts since its launch, setting a new industry standard in security and transaction efficiency. Through a zero-fee policy and an intelligent matching system, the HTX Select Zone has reshaped the trust mechanism for C2C trading while ensuring compliance and user experience, becoming a significant example of industry service paradigm升级.

Multi-Layered Capital Management and Brand Influence Resonate, Continuously Releasing Platform Ecosystem Vitality

Centered around different risk appetites and capital usage scenarios, HTX continued to完善 its capital management product matrix in 2025, including Earn, Leverage, and Margin Swap (formerly Loan), gradually building a multi-layered capital solution covering stable增值 and efficient trading. Data shows that HTX Earn served over 600,000 users throughout the year, with products covering more than 300 digital assets. Leverage and Margin Swap saw同步优化 in asset richness, capital utilization efficiency, and risk control capabilities, becoming a crucial支撑 for the platform’s professional trading ecosystem.

As the product system matured, HTX enhanced user engagement and fostered a positive cycle of trading activity through high-frequency, structured asset-related campaigns. In 2025, the platform held over 300 asset-related campaigns围绕热门资产, core trading scenarios, and strategic玩法, attracting participation from over a million users. Among them, activities like Launchpool and Trading Competitions not only improved liquidity and trading depth but also significantly increased user stickiness and community activity, serving as a纽带 connecting assets, users, and the platform.

Alongside the continuous growth in business scale and ecosystem activity, HTX achieved breakthroughs in industry influence and brand credibility. In 2025, HTX was强势入选 the Forbes “World’s Most Trusted Cryptocurrency Exchanges” list and saw its ranking跃升 in global comprehensive rankings on multiple mainstream data platforms. Global Advisor Justin Sun graced the cover of *Forbes* and won several industry awards. Its global investment arm, HTX Ventures, also received multiple annual investment institution awards for its forward-looking布局 in Web3 and primary markets. A CoinDesk research report indicated that as of November, HTX’s market share grew by 2.06% in 2025, ranking first among global mainstream centralized exchanges.

Through the协同共振 of capital management products, asset campaigns, and brand influence, HTX is building a comprehensive crypto asset platform that combines trading efficiency, user engagement, and a foundation of long-term trust, accumulating momentum for sustainable growth in future cycles.

Security and Compliance Progress Steadily, Solidifying Long-Term Trust Foundation

Security and compliance remain HTX’s most critical底线能力. The report shows that HTX continued to strengthen its security and compliance capabilities in 2025. The platform publishes Merkle Tree Proof of Reserves monthly, with the reserve ratio for major assets consistently maintained above 100%. Among them, USDT reserves grew by approximately 150% throughout the year, indicating a significant increase in user asset沉淀 and trust.

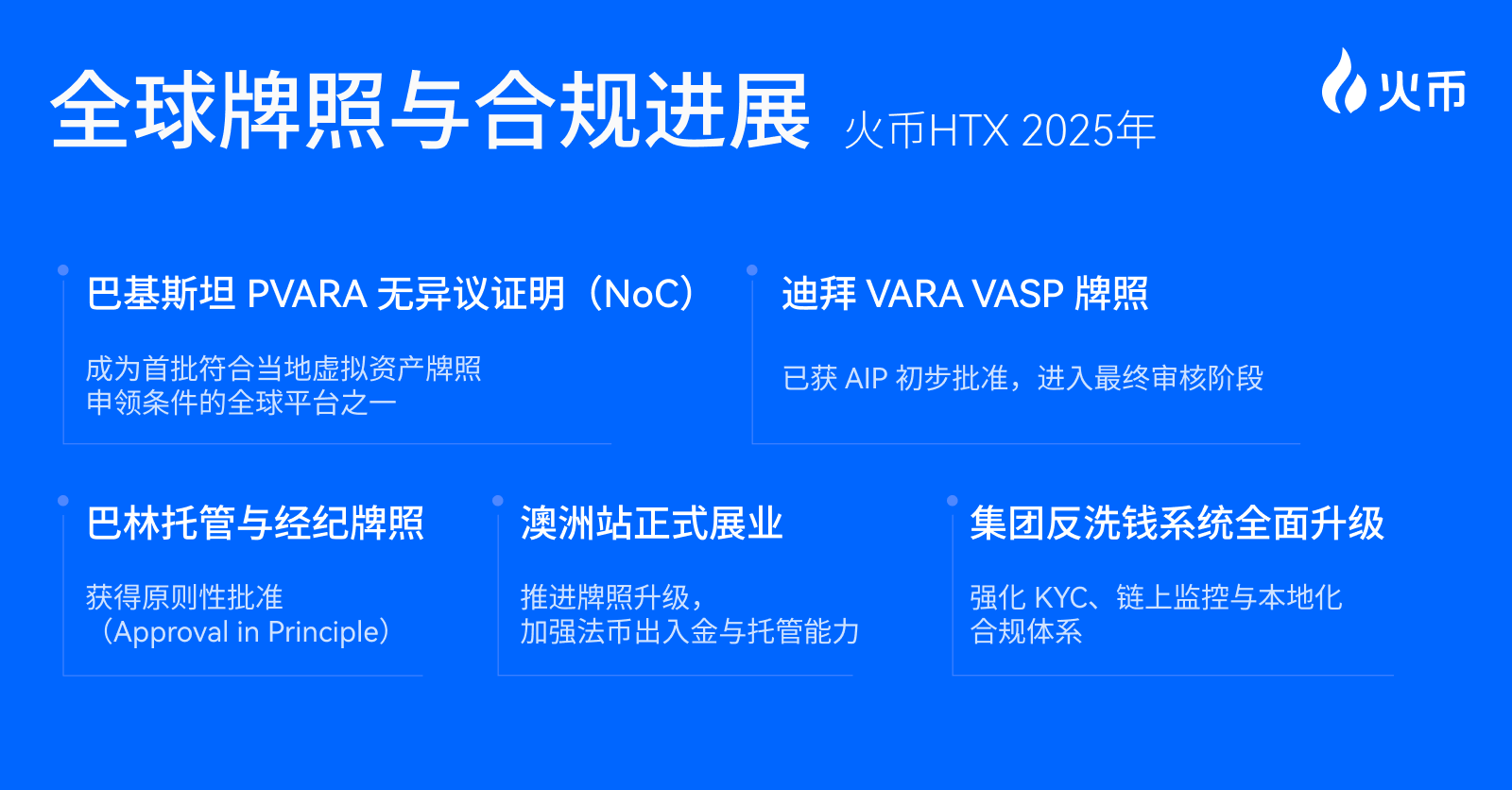

On the compliance front, HTX steadily推进 multi-regional licensing布局. It has officially become one of the first two global digital asset platforms to meet the application conditions for Pakistan’s Virtual Asset Service Provider (VASP) license. The platform is also advancing licensing and regulatory cooperation in key markets such as the Middle East and Australia, continuously upgrading its anti-money laundering (AML) and anti-crypto crime systems to strengthen the compliance foundation of its global operations.

Outlook for 2026: Focus on Core Trading Scenarios, Evolving Continuously with Stability

Standing at the starting point of a new cycle, HTX stated in the report that in 2026, it will continue to focus on the three core trading scenarios of spot, contracts, and C2C, deepening product specialization and user experience. Simultaneously, it will expand capital management efficiency, strengthen security and compliance construction, and promote long-term ecosystem prosperity through HTX DAO, research, and investment systems.

As HTX emphasized in the report—true growth comes from respect for time. In the rapidly changing crypto world, HTX is moving towards the next stage belonging to long-termists with a more稳健的节奏.

About HTX

HTX (formerly Huobi) was founded in 2013. After 12 years of development, it has evolved from a cryptocurrency exchange into a comprehensive blockchain business ecosystem encompassing digital asset trading, financial derivatives, research, investment, incubation, and other businesses.

As a leading global Web3 gateway, HTX adheres to a development strategy of global expansion, ecosystem prosperity, wealth effect, and security & compliance, providing comprehensive, secure, and reliable value and services to virtual currency enthusiasts worldwide.

To learn more about HTX, please visit https://www.htx.com/ atau HTX Square, and follow us on X, Telegram, Dan Perselisihan. For further inquiries, please contact [email protected].

Artikel ini bersumber dari internet: Huobi HTX Releases 2026 Opening Report: Trading Scale Grows Steadily, Building the Cornerstone for the Next Round of Growth with Long-termism

Related: The tetesan udara Hunter’s Arsenal: Six Key Indicators for Screening Truly High-Potential Projects

Compiled by Odaily Planet Daily ( @OdailyChina ) Translator | Dingdang ( @XiaMiPP ) Crypto airdrops may seem like “free money,” but seasoned crypto enthusiasts know that not every airdrop is worth the gas and effort invested. Over the past 5–7 years, I’ve participated in dozens of airdrops, some of which resulted in six-figure profits, while others left me with nothing. The difference lies in whether a sufficient assessment has been conducted. In this report, I will attempt to provide a framework for assessing airdrop potential. I’ve developed a relatively objective evaluation system to determine whether an airdrop opportunity is worth participating in or should be skipped. I’ll combine real-world examples (from the legendary Uniswap airdrop to the latest L2) and some quantifiable benchmarks to provide professional crypto practitioners and…