Circle’s own Arc is about to launch its own cryptocurrency. Will retail investors be able to get a share of the profits?

On November 12, Circle, a major stablecoin issuer, released its third-quarter business update, revealing that it is exploring issuing native tokens on its newly launched stablecoin public chain, Arc Network.

Circle is aiming to transform from a simple stablecoin provider into a more comprehensive blockchain ecosystem builder. As the issuer of USDC, Circle’s move may further solidify its leading position in the stablecoin financial sector, while injecting new vitality into the Arc Network.

Arc, launched by Circle, is a stablecoin public blockchain. Unlike general-purpose public blockchains such as Solana and Sui, it is a platform optimized for stablecoin payments, foreign exchange, and capital markets.

Arc Network, an L1 blockchain project launched by Circle, is led by Circle’s executive leadership, demonstrating the stablecoin giant’s professional approach to blockchain infrastructure. Circle’s CEO is Jeremy Allaire, who also serves as a co-founder of Arc, responsible for the company’s overall strategy, vision, and operational execution.

Its Chief Product Manager is Sanket Jain, who is also the Chief Product Manager of Circle and the co-founder of Gateway. He graduated from Cornell University with a degree in Applied Economics and previously worked as a financial analyst at Fountain Financial, LLC and in corporate restructuring analysis at Houlihan Lokey. The Chief Software Engineer is Adrian Soghoian, who previously worked at Trigger Finance and Google’s Chrome. He has many years of development experience.

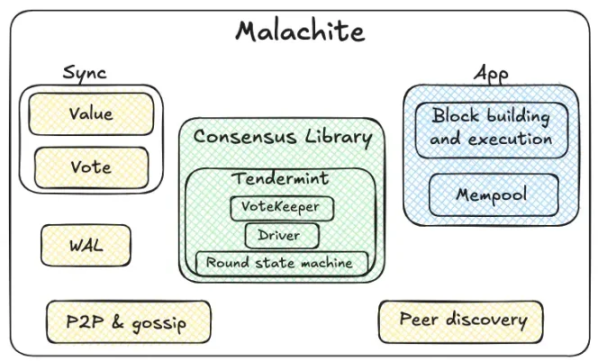

Arc’s core innovation lies in embedding USDC into the network’s underlying layer, avoiding the volatility issues of traditional gas tokens. Users can directly pay fees with USDC, achieving a seamless stablecoin trading experience. In August of this year, Circle Internet Group (CRCL) acquired Informal Systems’ high-performance consensus engine, Malachite, which employs a permissioned proof-of-authority mechanism, with its validator nodes being known authoritative institutions.

In late October, Arc launched its public testnet, opening it to developers and businesses. Currently, over 100 institutions have participated. Circle Payments Network already has 29 financial institutions on board and has added partnerships with Brex, Deutsche Börse, Finastra, Fireblocks, Kraken, Itaú, and Visa.

Circle Internet Group’s third-quarter financial report showed that the company’s revenue increased by 66% year-on-year to approximately $740 million, with a significant increase in net profit. This strong performance was attributed to the surge in the circulation of USDC—as of the end of the reporting period, USDC’s market capitalization exceeded $75 billion, ranking as the world’s second-largest stablecoin, second only to Tether’s USDT.

Against the backdrop of increasingly stringent global regulatory environments, Circle’s compliance advantages are particularly prominent. Its USDC has been recognized by the EU’s MiCA regulations and is widely used in many mainstream exchanges and DeFi protocols.

Unlike traditional blockchains, Arc uses USDC as its native gas token, meaning transaction fees can be paid directly in USDC, enabling instant settlement and privacy options. The network is EVM-compatible, facilitating application migration for developers, and is deeply integrated with the Circle ecosystem, including tools such as USDC, CCTP (Cross-Chain Transfer Protocol), and Gateway.

In its Q3 results, Circle explicitly stated: “We are exploring the possibility of issuing native tokens on the Arc network, which will boost network engagement, drive adoption, further align the interests of Arc stakeholders, and support the long-term growth and success of the Arc network.”

Although this statement is still in the “exploratory” stage, it is enough to stimulate market imagination.

Why issue क्रिप्टोcurrency?

In the stablecoin market, Tether, as the issuer of USDT, is actively building its own blockchain ecosystem by launching the Plasma and Stable networks. This directly prompts Circle to accelerate its exploration of native token issuance on the Arc network in order to maintain its competitive advantage.

Plasma, a stablecoin public chain backed by Tether, is optimized for USDT payments, supports zero-fee USDT transfers, and is EVM compatible. Its token offerings and deposits have attracted numerous investors, generating significant popularity and traffic. Currently, its token XPL has a market capitalization of $490 million, and its FDV is still $2.6 billion. Stable, another stablecoin public chain backed by Tether, also attracted massive amounts of funds after opening deposits. The first phase’s $1 billion quota was quickly filled, and the second phase’s $500 million quota was also expanded due to overwhelming participation, ultimately resulting in nearly $1.8 billion in total deposits across both phases.

Tether has firmly established its market dominance through the expansion of its stablecoin public blockchain, exchanges, and trading pairs. USDC remains in a catch-up role.

U.S. Treasury Secretary Bessant said today that the size of stablecoins could grow from $300 billion to $3 trillion by 2030, a tenfold increase.

The market is also very receptive to the narrative of stablecoin public chains. USDE’s market capitalization surged to nearly $15 billion in just two years, and many stablecoins have emerged from public chains and DeFi protocols.

Circle’s listing in the US only caters to the investment needs of American investors, failing to meet the needs of its native community. A native token is the real game-changer for attracting attention within the community.

It not only helps attract more community participants and incentivize network engagement, but also increases Arc adoption. Circle’s report emphasizes that this token will “drive network growth,” suggesting its potential synergy with the USDC ecosystem to form a closed-loop economic model. The addition of a native token will make this ecosystem more attractive, significantly drawing in DeFi, RWA (Real-World Asset), and cross-border payment applications.

Arc’s native token addresses pain points of current stablecoin networks, such as high gas fees and cross-chain fragmentation. Through governance incentives, Arc could become the platform of choice for RWA and DeFi, attracting funding from institutions like BlackRock—Circle has already partnered with BlackRock on the USDC fund.

Furthermore, with the convergence of AI and Web3, Circle’s AI tools, combined with its token, can accelerate the development of its developer ecosystem. On the challenge side, token issuance requires a balance between centralization and decentralization. Arc’s current permissioned design may limit community participation, and improper token design could trigger a speculative bubble. बाज़ार competition is fierce: L1 tokens like Solana and Base are already mature, and Arc needs to prove its unique advantages as a stablecoin.

In the long run, this exploration aligns with the evolutionary trend of blockchain: from a general-purpose platform to a vertical ecosystem. Circle’s Q3 profit growth proves the sustainability of its business model, and its native token will be the catalyst.

Currently, participants can receive test coins on the testnet and then participate by deploying contracts on the testnet. The official team has released detailed tutorial documents .

With Plasma and Stable deposits attracting numerous participants, and Coinbase launching its ICO platform and announcing Monad as its first project, it remains to be seen whether ARC will also open up ICO quotas.

यह लेख इंटरनेट से लिया गया है: Circle’s own Arc is about to launch its own cryptocurrency. Will retail investors be able to get a share of the profits?Recommended Articles

Against this backdrop, another group of trading platforms is also catching up quickly. Among them, XT.COM (hereinafter referred to as XT) has particularly caught our attention. With the number of assets it supports (more than 1,300 tokens and more than 1,300 trading pairs), the richness of its products and its sensitivity to market trends (such as launching Card and prediction services in addition to basic trading), low fees and a transparent fee structure, and online and offline activities that keep up with the latest trends, it has accumulated more than 12 million traders from more than 200 countries, with 2 million monthly active users. To gain insight into the methodology behind achieving these data results, we engaged in a dialogue with XT COO Tracy Jin, delving into brand philosophy, business…